If you own a small business, you’ve probably found yourself knee-deep in spreadsheets, receipts, and the occasional existential crisis while trying to track your company budget.

You’ve got income from sales, expenses for supplies, salaries (if you’re lucky enough to have employees), marketing costs, and a million other little things that pop up. It’s like juggling flaming torches while riding a unicycle—one misstep and WHOOSH! There goes your carefully crafted budget.

But no worries: it’s easy to stay on top of things if you start with a solid plan and keep a close eye on your spending.

In this article, we’ll dive into six field-proven techniques for tracking your business budget and offer actionable tips to help you confidently maintain control over finances and achieve business goals.

What Is Business Budget Tracking and Why Is It Important?

Business budget tracking is all about monitoring what a company spends and makes. It’s a lot like checking your personal bank account. With it, you might find yourself in the wilderness of unexpected expenses and cash flow issues.

First, tracking your budget helps you get a clear picture of your financial health. You know exactly how much you’re earning and spending, which means no more guessing games! Clarity allows you to make informed decisions—like whether you can afford that shiny new piece of equipment or if it’s time to cut back on certain tasks.

Next, when you keep tabs on your budget regularly, you start to notice trends. Certain products are flying off the shelves while others are gathering dust. Or you may find that your marketing efforts are taking more and paying off less than you expected. These insights help you pivot your strategy, focus on what’s working, and ditch what isn’t.

Besides that, with effective budget tracking, you’ll easily avoid those nail-biting moments when bills are due, and money is tight: you forecast your cash flow need, plan ahead for lean months, and ensure you have enough cushion to ride out the rough patches.

Budget tracking allows you to create achievable milestones that keep you and your team motivated and accountable without setting yourself up for disappointment. Want to increase sales by 20% next quarter? Great! But first, look at your current numbers and see what’s feasible.

It’s like having a personal trainer for your finances; it keeps you on track and helps you resist the temptation to splurge unnecessarily.

6 Easy Ways to Track Small Business Budget

Here are six super simple and effective budget-tracking techniques that can help you keep your finances in check without losing your mind. Let’s dive in!

Spreadsheets – Your Old Buddy

Ah, the trusty spreadsheet! It’s like the Swiss Army knife of budgeting. Whether you’re using Excel or Google Sheets, creating a budget spreadsheet can help you track income and expenses in real time. You can customize it to fit your needs—add categories, create charts, and even set up formulas to calculate totals automatically.

Pros

- Customization. Spreadsheets are like a blank canvas! You can create whatever layout works for you, add color codes, and even throw in some fancy formulas to automate calculations.

- Cost-effectiveness. Most spreadsheet software (like Google Sheets) is free or super cheap. If you’re running your business on a tight budget, this is a huge win. You get powerful budgeting tools without breaking the bank.

- Sharing. Need to collaborate with your accountant or business partner? Just share the file! Cloud-based options like Google Sheets make it super easy to work together: no more emailing back and forth.

- Data organization. Spreadsheets keep everything organized in one place. You can categorize expenses, track income, and even create summaries.

- Learning curve. If you’re already familiar with spreadsheet software, jumping in is a breeze. There are tons of templates available online, so you don’t have to start from scratch.

Cons

- Time expenditures. Let’s be real—manually entering data can take forever! If you have a lot of transactions, it can feel like a never-ending chore, and if you forget to update it regularly, you might end up drowning in a sea of receipts.

- Human error. Typos and miscalculations can happen, and they can throw off your entire budget: one wrong number can lead to big headaches down the line.

- Limited functionality. While spreadsheets are great for basic budgeting, they might not have all the features you need as your business grows. Advanced analytics or forecasting tools might require more specialized software.

- Lack of automation. Unlike dedicated budgeting apps that sync with your bank accounts and automatically categorize expenses, spreadsheets require manual input. This means more work for you—yikes!

Best Fit for

- Startups: With limited resources, startups can use spreadsheets to manage their initial budgets effectively.

- Freelancers: Individuals running their own businesses can use spreadsheets to monitor income, expenses, and project profitability.

- Nonprofit organizations: Nonprofits can utilize spreadsheets to manage donations, grants, and operational costs while ensuring transparency in financial reporting.

Summary

Spreadsheets can be a fantastic tool for budgeting if you love customization and organization, but they also come with their fair share of drawbacks. If you’ve got the time and patience, they can be a great asset to your small business. But if you’re looking for something more automated and user-friendly, it might be worth exploring dedicated software tools.

Budgeting Software – Bigger Solutions for Bigger Decisions

If spreadsheets aren’t your jam, fear not! There are tons of budgeting tools out there that can make your life easier. Software like QuickBooks, Mint, or YNAB (You Need A Budget) can help you track expenses on the go. These tools can automatically categorize your transactions, give you real-time updates on your spending, and let you whip up reports that fit your needs. But their price hurts!

Many of these even sync with your bank accounts, so you can see where your money is going without manually entering everything.

Pros

- Streamlined processes. Professional budgeting tools often come with features that automate repetitive tasks. They can pull in data from your bank accounts, invoices, and expenses, making everything a lot smoother.

- Advanced analytics. Most budgeting tools offer powerful reporting features that give you insights into your financial health. You can easily track trends, forecast future expenses, and make data-driven decisions.

- Collaboration. If you have a big team, professional tools allow for easy collaboration. Multiple users can access and edit the budget simultaneously, ensuring everyone is on the same page. Plus, you can control who sees what, keeping sensitive information secure.

- Integrations. Professional budgeting tools integrate seamlessly with other software you might already be using, like accounting systems or project management apps.

- Scalability. As your business grows, your budgeting needs will likely change. Professional tools are designed to scale with you, offering features that cater to larger budgets and more complex financial situations.

Cons

- Cost. Professional budgeting tools often come with a price tag. Those subscription fees can feel like a burden for small businesses just starting out.

- Learning curve. New software can be intimidating: some budgeting tools have a steep learning curve, which could lead to frustration if you or your team aren’t tech-savvy. You might spend more time learning the tool than actually using it effectively.

- Overkill for simple budgets. If your business is small and your budget is straightforward, investing in a professional tool might be overkill. Sometimes, a simple spreadsheet does the trick just fine!

- Customization limitations. While many tools offer templates and features, they may not always fit your specific needs perfectly. You might find yourself wishing for certain functionalities that just aren’t available.

Best Fit for

- Large corporations: Enterprises typically have complex financial structures, multiple departments, and extensive reporting requirements. Advanced software can handle large datasets and provide detailed analytics.

- Manufacturing companies: These have intricate cost hierarchies, including raw materials, labor, and overhead. Professional budgeting software can provide insights into cost control and operational efficiency.

- Retail chains: With numerous locations, retail chains need to track sales, inventory, and operating expenses across various stores. Professional software can provide consolidated reporting and analysis.

- Financial services: Banks, investment firms, and insurance companies require robust budgeting tools to manage risks, compliance, and profitability across various financial products.

Summary

So, should you invest in a professional budgeting tool? It really depends on your business’s unique needs and circumstances. If you’re looking for advanced features and the ability to scale as you grow, it might be worth the investment. However, if you’re just starting out or have a simple budget to manage, sticking with spreadsheets could be the way to go.

Project Management Software – Value for Money

If you’re knee-deep in project management and trying to keep your finances in check, you’ve probably considered using those nifty budget-tracking features that come with project management software. But is it really worth it? Let’s break down the pros and cons of using these tools to track your business budgets.

Pros

- All-in-one solution. Forget juggling multiple tools! With budget tracking integrated into your project management software, you can keep everything in one place. Tasks, timelines, and budgets all live under the same roof. Talk about convenience!

- Real-time updates. Most project management tools give you real-time insights into your budget. You can see how much you’ve spent at any given moment, which helps you make quick decisions without the guesswork.

Customizable reports. Want to see where your budget is going? Many tools offer customizable reporting features that let you generate reports tailored to your needs. You can slice and dice the data however you like! - Planning. Project management tools let you forecast future spending based on current trends, helping you plan better for upcoming projects.

Cons

- Costly add-ons. While many project management tools are affordable, some budget tracking features can come with extra costs. Make sure you know what’s included in your subscription before you get too excited.

- Overwhelming data. With all that data at your fingertips, it can sometimes be a bit overwhelming. If you’re not careful, you might find yourself drowning in numbers instead of making informed decisions.

- Integration issues. If you’re using other financial software or tools, integrating everything can sometimes be a headache.

Best Fit for

- Creative agencies: Whether you’re a graphic designer or a marketing consultant, project management software can help you keep your projects on budget. Track expenses related to each client and ensure that you’re staying profitable.

- Small retailers: For those running local shops or e-commerce stores, budget tracking features can help you monitor inventory costs and marketing expenses without breaking a sweat.

Event planners. Planning events can get pricey! Use project management software to allocate budgets for different aspects of the event—venue, catering, entertainment—and track them all at once. - Consulting firms: If you’re in consulting, keeping track of billable hours and associated expenses is crucial. Project management tools can help ensure you’re not leaving money on the table.

- Construction companies. Small construction firms can benefit immensely by tracking labor costs, materials, and project budgets all in one place, ensuring projects stay on track financially.

Summary

Using project management software for budget tracking isn’t just smart—it’s sometimes essential for keeping your small business thriving.

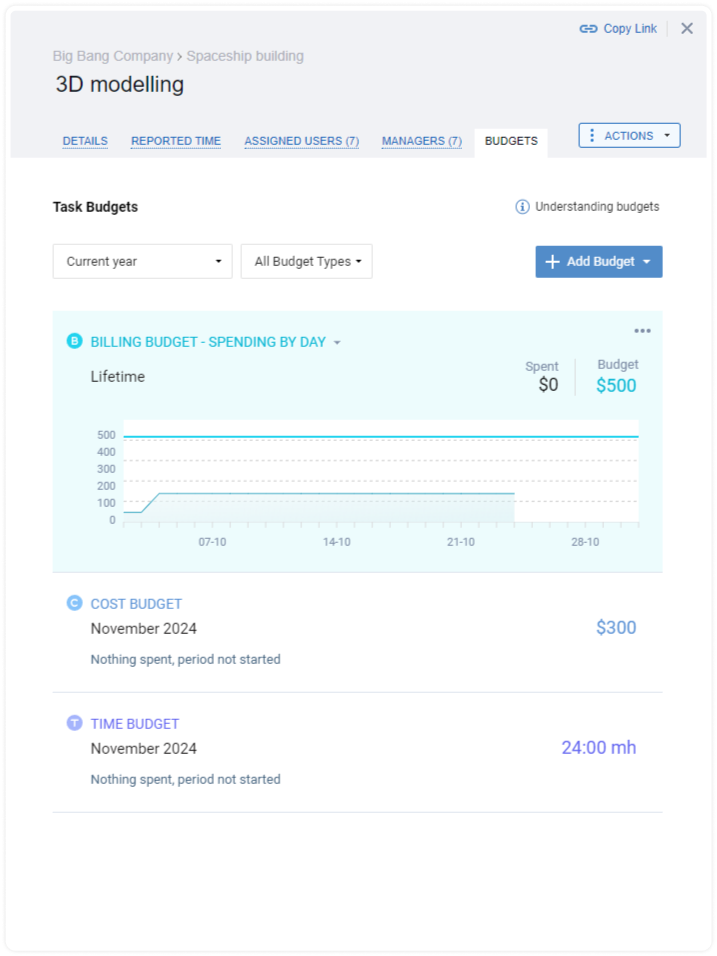

For a start you can try actiTIME, a time tracking and project management tool, that, among other matters, lets you monitor budgets for costs, time, and billing at every level, whether it’s by customer, project, or task.

• The cost budget shows if your staff expenses are nearing critical thresholds, ensuring that your project remains financially viable and helps prevent overspending.

• The time budget gives you visibility into how your hours are allocated and allows you to adjust your schedule for optimal productivity.

• The billing budget functions as a protective measure, ensuring that you stay within the financial limits set by your clients, giving you the chance to make necessary adjustments before issues arise.

Thus, project planning and coordination become more precise, you can save time, reduce stress, and focus on what you do best: growing your business!

Personal Finance Software – Your Pocket Assistant

If you’re just starting out or running a very small operation, personal finance apps pop up as a tempting option for tracking your budget without breaking the bank. It gives you a clear picture of your finances, showing everything from bank accounts to credit cards and investments, so you can easily see where your money is going. But is it really the right fit for you?

Pros

- Useir-friendly interface. Most personal finance software is designed for common folks, not finance gurus. This means these apps have intuitive layouts that make it easy to track income and expenses without feeling like you need an MBA.

- Basic features. For many small businesses, the basic features – like expense tracking, invoicing, and budgeting – are often all they need. So, personal finance apps will let you manage your cash flow without getting overwhelmed by unnecessary complexities.

Accessibility. Most personal finance software comes with mobile apps, allowing you to check your finances on the go. This is perfect for busy entrepreneurs who are always on the move! - Integration with bank accounts. Personal finance software allows you to link your bank accounts and credit cards, making it easier to track transactions automatically.

Cons

- Limited features for business. While personal finance software is great for individuals, it might lack the advanced features that businesses require—like payroll management, tax calculations, and detailed financial reporting.

- Scalability issues. As your business grows, you might find that personal finance software can’t keep up with your needs. Upgrading later might mean switching to a completely different system, which can be a hassle.

- Potential security concerns. While many personal finance tools are secure, they might not have the same level of data protection as dedicated business software. Your financial data is sensitive, and you want to ensure it’s well-protected.

- Taxation issues. Personal finance software is not designed to handle the complexities of business taxes, which could lead to headaches come tax season. You might end up needing additional software or professional help anyway.

Best Fit for

- Home-based businesses: Businesses operating from home, such as craft makers or virtual assistants, can benefit from the simplicity of personal finance software to manage their finances.

- Real estate agents: Independent real estate agents can track commissions, expenses, and marketing costs effectively using personal finance tools.

- Health and wellness coaches: Personal trainers or wellness coaches with simple financial needs can manage client payments and expenses without needing complex accounting systems.

Summary

Personal finance software can be beneficial for a variety of companies, particularly those that may not require extensive accounting features, but if you’re looking to scale or need more advanced features, it might be worth investing in dedicated small business accounting software down the line.

Receipt Tracking – the Good, the Bad, and the Sticky

Tracking your receipts is a smart move to make sure you’ve got all your business expenses covered. You can do it the old-school way with paper or use a digital receipt tracking app that saves your receipts online and sorts your expenses for you.

Pros

- Visibility. Tracking your receipts helps you identify unnecessary expenses and make adjustments to your budget.

- Tax time made easy. When tax season hits, having all your receipts in one place makes life so much easier. You’ll have everything you need to claim deductions and avoid the dreaded audit.

- Accountability. If you’re working with a team, having everyone track their receipts can create a culture of accountability. Everyone knows they need to keep tabs on their spending, which can lead to more mindful financial decisions.

Cons

- The paper trail. While digital tracking is fantastic, some folks still cling to paper receipts. Those little slips can fade or get lost, leading to headaches down the line, and if you’re not careful, you might end up with a mountain of paper clutter.

- Potential for errors. Mistakes happen! Whether it’s miscategorizing an expense or accidentally deleting a receipt, errors can lead to inaccurate financial reporting. You have to double-check your entries to avoid surprises later.

- Tech troubles. Technology isn’t always our friend. Apps can crash, data can get lost, and sometimes user interfaces are just plain confusing. If tech isn’t your strong suit, you might find yourself feeling frustrated rather than empowered.

Best Fit for

- Small retailers: For those running a small shop, keeping track of inventory purchases and other expenses is essential. Receipt tracking can help you analyze which products are moving and which are just sitting there collecting dust.

- Food trucks and cafes: If you’re in the food business, you know how quickly costs can add up – ingredients, permits, equipment… the list goes on! Keeping an eye on those receipts can help you stay profitable and spot areas where you might be overspending.

- Service-based businesses: Whether you’re a consultant, a coach, or a handyman, tracking your receipts can help you determine how much to charge clients. Plus, it can help you identify any hidden costs that could be eating into your profits.

Summary

So, should you dive into receipt tracking? If you’re someone who thrives on organization and wants to simplify your financial tracking, then go for it! But if you’re more of a free spirit who prefers to keep things loosey-goosey, you might want to consider other methods.

Bank and Credit Card Statements – Automated and Free

Another method that often gets tossed around is using bank and credit card statements to track your budget. Sounds simple, right?

Checking your bank and credit card statements regularly is a great way to get a clear picture of where your business’s money is going. It helps you spot any weird transactions and ensures all your expenses are on point.

Pros

- Automation. Your bank and credit card statements do most of the heavy lifting for you! Every transaction is recorded, so you don’t have to manually jot down every expense.

- Comprehensive overview. With everything in one place, you can easily visualize your cash flow. Want to know how much you spent on supplies last month? Just pull up that statement, and voilà! Instant insight.

- Transaction categorization. Many banks and credit card companies categorize your transactions automatically. This means you can quickly see how much you’re spending on different categories—like dining out or office supplies—without lifting a finger.

Cons

- Missing details. While statements show you the “what,” they often lack the “why.” You might see a charge for $50 at a restaurant, but was it a client meeting or just lunch with friends? Without context, it’s tough to make informed decisions.

- Overlooked expenses. If you’re only relying on statements, you might miss out on cash transactions or expenses that didn’t go through your bank account. Those little costs can add up and throw off your budget.

- Complicated transactions. If you have multiple income streams or complex transactions (like refunds or splits), statements can get messy. You might find yourself scratching your head trying to figure out what’s what.

Best Fit for

- Solopreneurs: If you’re flying solo, this method is a lifesaver! You can easily track client expenses and income without the hassle of complex accounting software. Plus, it helps you keep an eye on those pesky freelance fees.

- Small retail shops: If you own a brick-and-mortar store, keeping track of inventory and expenses is crucial. Bank statements can help you see how much you’re spending on supplies versus what you’re bringing in—perfect for making informed decisions about restocking.

- E-commerce: Selling online? Your bank statements will show you not just sales but also shipping costs, platform fees, and advertising expenses. This info is gold when it comes to understanding your overall profitability.

Summary

Using bank and credit card statements to track your small business budget can be a game-changer, especially if you’re looking for convenience and ease of access. It’s simple, efficient, and gives you the insights you need to make smart financial decisions. But don’t forget about those pesky details that might slip through the cracks!

So, if you decide to go this route, consider combining it with other methods — like keeping an eye on receipts or using budgeting software — to create a more comprehensive financial picture.

Final Thoughts

Tracking small business expenses doesn’t have to be a headache! Whether you opt for spreadsheets, apps, or even pen and paper, the key is finding a method that works for you.

So, take some time to explore your options and choose what feels right.