Whether running a small business or just trying to keep your finances in check, a budget tracking tool can be your best friend.

No more receipts piling up, invoices scattered everywhere, and so on, not to mention those random subscriptions you forgot about! A budget tracker helps you pull everything together in one place.

You can categorize your expenses, set budgets for different areas, and see where your money is actually going.

But hold up! Before you dive into the sea of budgeting apps and tools, let’s chat about the key differences between personal and business budget tracking. It’ll save you a ton of headaches down the road!

Business vs. Personal Budget Tracking

First off, think about why you’re tracking your budget. Personal budgeting is all about managing your day-to-day finances. You’re tracking your income and expenses to ensure you’re living within your means and saving for future goals, like that shiny new gadget or a cozy home.

In personal budgeting, your income usually comes from a single source—your job (or multiple jobs if you’re juggling). It’s pretty straightforward: you know when you get paid and how much.

That’s why personal budgets tend to be more flexible. If you overspend one month on groceries because you couldn’t resist that gourmet cheese, you can adjust your budget for the next month without too much stress.

Business budgeting, on the other hand, is a bit more complex. It involves planning for revenue, expenses, and profits over a specific period. The goal? To keep your business afloat, grow it, and make informed decisions about investments and expenditures.

In business, income often comes from various streams—sales, services, investments, etc, and you need to forecast these sources accurately because they can fluctuate month to month.

Consequently, business budgets need structure and discipline. If you spend more in one area, it could impact your cash flow or ability to pay employees. This means sticking to your budget is crucial!

So, what’s your main goal? Knowing this will help you pick the right tool for the job!

Top Business and Personal Budget Trackers

There are tons of user-friendly apps for personal budget tracking out there, or even good old Excel. They let you track your spending in real-time and help you visualize where your money is going.

Business budget tracking might require more robust tools that will help you manage invoices, expenses, and payroll all in one place. You might also need to create detailed spreadsheets or even hire an accountant to ensure everything’s in order.

Let’s find out what works best for you!

Business Budget Trackers

actiTIME: The Swiss-Army Tracker

- Multi-level budget tracking

- Spending visualization

- Task and project management features

If you’re not just keeping track of your business budget, but also juggling a million of things like performance analysis, project progress monitoring, and costs justification, actiTIME can make your life a bit easier.

Set up budgets for costs, time, and billable amounts all in one place and monitor your expenses without getting lost in spreadsheets or sticky notes!

- The cost budget displays staff-related costs, which is a lifesaver for avoiding those dreaded budget blowouts.

- The time budget provides clarity on how work hours are spent and enabling you to refine your schedule for maximum efficiency.

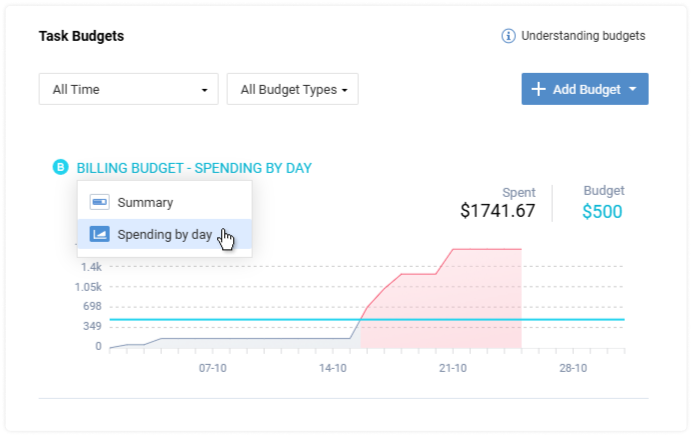

- The billing budget acts as a financial safeguard, helping you remain within the limits set by your customers.

Another great thing about actiTIME is how visual it is. You can see colorful graphs and charts that show how your project is tracking against its budget in real-time and spot any red flags before they become big issues.

Why you might think twice

If you are only looking for a budget tracker and don’t plan to utilize the rest of the functions, actiTIME may not be the most cost-effective solution for you.

Cost

From $5 user/month.

Board by BudgetBakers: A Little That Goes a Long Way

- Real-time updates

- Alerts

- Forecasting

Board isn’t just another run-of-the-mill budgeting tool; it’s a comprehensive platform designed to help businesses of all sizes keep their finances in check.

Board combines business planning, sales tracking, and cash flow management. It is especially handy for startups trying to figure out their cash runway and gearing up for fundraising. But it doesn’t stop there! If you’re scaling your business, Board helps you keep tabs on your sales pipeline and revenue forecasts, ensuring you stay aligned with your growth plans.

The best part? Board helps businesses maintain their operating profitability and keep control over free cash for future investments.

Forget about relying on gut feelings or guesswork! Board gives you real-time insights powered by statistical models that deliver forecasts and timely alerts.

Why you might think twice

Some users have noted that if you’re a client of a smaller bank, integrating your account with Board can sometimes be a hassle. While it claims to support various banks and accounts, the process isn’t always seamless.

Cost:

- Free,

- From $10 a month.

Ramp: Your Ultimate Expense Monitor

- Card issuing

- Vendor management

- Budget building

Ramp combines expense tracking and corporate cards into a single, easy-to-use interface. Whether you’re a startup or a big enterprise, Ramp will help you keep tabs on your expenses, automate your processes, and ultimately save some serious cash.

With over 60 bank integrations, you can manage all your accounts from one centralized platform while Ramp Intelligence collects insights into your spending habits, alerting you to overpriced vendors and duplicate subscriptions.

Why you might think twice

Just keep in mind that if you want to dive deep into the nitty-gritty of every single transaction, Ramp might not be your best bet, as its reporting functionalities are a bit limited.

Cost:

- Free,

- From $15 user/month.

Payhawk: Where Your Budget Goes Live

- Live comments

- Expense visualization

- Historical data analysis

Payhawk is a global spend management solution helping finance teams across 32 countries create a culture of accountability and informed decision-making.

Their brand-new real-time budgets feature gives finance teams and business owners a live overview of how budgets are being utilized. Budget owners can filter data in super granular detail to quickly see who’s spending what and discover overspending with a supplier or that one employee is racking up expenses faster than others.

Besides that, you can whip up budget templates that fit your needs, download them as Excel files, or upload them to track and plan your budgets easily.

Why you might think twice

While Payhawk is packed with helpful features, it can take a bit of time to get fully acquainted with all of them. If you’re used to a more basic system, be prepared for a learning curve.

Cost: Payhawk’s pricing structure isn’t one-size-fits-all; it varies based on the features you need and the size of your business.

Budget Trackers for Freelancers and Solopreneurs

Monarch: For Those Who Take Finances Seriously

- Unlimited collaborators

- Infinite goals

- Graphs and charts

Monarch covers most of the bases people look for in a personal finance app and far beyond.

It lets you connect all your accounts, including bank accounts, credit cards, investments, loans, and even crypto. This means you can track everything at once without jumping from app to app. Plus, it can even look up your home address and car’s VIN to keep tabs on their value. Pretty nifty, right?

If you want a comprehensive dashboard that gives you a full picture of your finances and you’re willing to invest a little time into using the app, then Monarch is here for you too!

Got dreams like saving for a down payment on a house or planning that epic trip to Paris? Monarch lets you create custom goals and link them to your financial accounts.

You can also use Monarch on its website alongside the app. And if you share finances with someone else (a partner or a financial buddy), you can invite them to join your account at no extra cost — perfect for joint bank accounts!

Why you might think twice

Let’s be real—Monarch isn’t the cheapest option out there. It might make your wallet a bit lighter. And if you’re looking to keep an eye on your credit score, you won’t find that feature here.

Cost: $14.99 a month or $99.99 a year.

FreeAgent: Your Accounting Gamechanger

- No extra fees

- Easy data export

- Unlimited users

FreeAgent stands out in the crowded online bookkeeping market, competing with established business budgeting tools like FreshBooks, QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books, and Kashflow.

The toolset is solid: invoicing, estimates, and receipts all in one spot. And the best part? You pay a flat monthly fee for all these goodies.

With FreeAgent, you can easily keep tabs on your profitability, cash flow, and upcoming tax deadlines. And the “Radar” feature alerts you to unpaid invoices and important deadlines while giving insights into which clients are quick to pay (and which ones aren’t).

Why you might think twice

There’s just one pricing tier. While it’s a sweet deal for small teams, it might feel a bit steep if you’re flying solo.

Cost:

- £33 a month + VAT for limited companies,

- £27 a month + VAT for partnerships/LLPs,

- £19 + VAT a month for traders.

Every single new customer gets 50% off in the first 6 months.

If you choose to pay annually, your 50% discount gets extended for an entire year.

Credit Karma: Mint Reimagined

- Free with no limits

- Credit builder

- Integrated assistant

Originally, Credit Karma was all about giving you the lowdown on your credit score. But guess what? It’s come a long way since then!

Credit Karma lets you link your bank accounts and credit cards, so you can easily see where your money is coming from and where it’s going. No more guessing games! You get a clear picture of your cash flow, which is crucial for freelancers who often deal with variable income.

Track your net worth, manage your debt, and even pay your bills—all for FREE!

Why you might think twice

Just keep in mind that if you want to dive deep into the nitty-gritty of every single transaction, this app might not be your best bet. And if targeted ads for financial products aren’t your thing, you might want to think twice about signing up.

Cost: Free.

Personal Budget Trackers

YNAB: The Hands-On Zero-Based Budget Tracker

- Mobile access

- Alexa support

- Account sharing

YNAB (You Need a Budget) is a cool personal budget tracking tool that’s designed to teach you smarter ways to manage your money so you can save more. It’s based on solid principles of financial responsibility that can totally change how you view your cash flow.

YNAB is all about planning ahead instead of just looking back at what you spent. It uses a zero-based budgeting method, which means you give every single dollar a job right when you get paid.

So, when that paycheck hits your account, you decide how much goes to spending, saving, or tackling debt. This approach makes you really think about where your money’s going, helping you be more intentional with your cash.

YNAB is pretty straightforward, and if you’re new to budgeting, their website is packed with helpful resources to get you up to speed on how to use the app effectively.

Sure, it has a bit of a learning curve and needs regular check-ins, but once you get the hang of it, you’ll have a flexible monthly spending plan that fits your goals.

Why you might think twice

It requires a bit of commitment to keep up with YNAB. If you’re not into actively managing your budget, it might not be for you. And it’s on the pricier side, so if you’re trying to save some bucks, check out some free apps later on.

Cost: $14.99 a month or $109 a year.

College students get a whole year free!

Goodbudget: The Envelope Budgeting App

- Transaction tracking

- Reporting

- Bank-level encryption

Goodbudget is a budgeting app that uses the old-school Kakeibo system (which means “household account book” in Japanese). It helps you see how much cash you’ve got for each expense and how much you’re saving each month.

You take your paycheck and split it into different “envelopes” for stuff like paying off debt, kid expenses, groceries, and transportation. When you spend money, you just update the envelope in the app.

Goodbudget is perfect for families who want to keep track of expenses and goals together.

Why you might think twice

Unfortunately, Goodbudget doesn’t link to your bank accounts or any other tools. So, you need to manually record your transactions or upload them from a file. No connecting credit cards or loans either!

Cost:

- Free,

- From $10 a month or $80 a year.

Pocket Guard: Your Personal Money Manager

- Export to Excel

- Subscription monitoring

- Financial literacy tips

Whether you’re looking to create a personalized budget, track your bills, or even tackle your debt, this tool has got you covered.

PocketGuard makes budgeting super simple by bringing all your financial activity together in one place. by gathering all your financial stuff in one spot. You can link as many bank accounts as you want (or just a few) to see your spending all in one dashboard. When you connect an account, it automatically finds your recurring bills and income, so you can hit the ground running with your budget.

Not into linking accounts? No worries—you can just add your spending manually.

One of the coolest features is called “In My Pocket.” It shows you exactly how much cash you have left to spend after accounting for all your expenses.

If you’re looking to free up some cash for fun stuff (or just to save more), PocketGuard helps with that too. You can negotiate lower bill payments, cancel subscriptions you don’t use, set SMART savings goals, and even customize a debt repayment plan.

And here’s another bonus: when you fill out your profile, PocketGuard will serve up personalized offers for similar services. Think lower rates on bills like cable and cell phone plans.

Why you might think twice

This app does a lot of the heavy lifting for you. That’s great for a chill budgeting experience, but not so much if you prefer getting hands-on with your money planning.

Cost:

- Free,

- From $12.99 a month or $74.99 a year.

Finding Your Balance

At the end of the day, both personal and business budget tracking serve the same purpose: helping you understand where your money is going and how to make it work for you. Whether you’re budgeting for that epic vacation or ensuring your business stays profitable, having a solid grasp of your finances is key.