Business budgeting is a complex process, and it poses a plethora of problems for any organization.

Here are the main business budgeting challenges according to this study:

- Budgeting is time-consuming.

- It limits organizational flexibility and adaptability to change.

- It’s hard to align with the overall business strategy.

- It doesn’t allow for creativity and, thus, often prevents companies from seizing new opportunities.

- It’s usually mainly concerned with costs and doesn’t really help to add value.

However, these disadvantages can be overcome with the right approach, and we believe that the below 10 business budgeting tools will empower you to do just that.

With their assistance, you will:

- Gather relevant, diverse, and highly accurate data to inform your budgeting process.

- Easily monitor the ongoing use of resources instead of overly focusing on the end results.

- Get access to the most advanced forecasting tools that will help you become more agile.

- Grasp a bigger picture and align your budgets with key value drivers.

- Automate the entire budgeting process and save a lot of time.

Ready?

Let’s get started!

10 Best Business Budgeting Tools to Try

1. actiTIME

Key features:

- Budgeting at multiple levels

- Comprehensive resource management

- Visual progress tracking

- In-depth performance reports

actiTIME is a multifunctional project management solution. Though not a business budgeting tool per se, it has a lot to offer in terms of resource allocation and tracking:

- You can manage not only cost budgets but billing and time budgets as well. Such a comprehensive approach to resource management promotes a much greater cost-efficiency than financial management alone.

- All three types of budgets can be allocated at multiple levels at once: customers, projects, and individual tasks. As a result, you can get a bird’s-eye view along with a granular picture of where your resources go.

- Each budget is supplied with a visual progress bar that makes it super-easy to see when the risk of project overrun approaches.

- Set email notifications on budget overruns to receive automatic alerts when your team reaches a critical amount of costs per project.

- Using visual charts and reports, you can scrutinize all aspects of your project performance: staff-related expenses, hourly revenues per task, the use of working time, overtime and absence costs, etc. Apply this data to analyze your financial results in depth and get better at project estimation.

Best for:

Project teams that want to better control their expenses (and other essential resources).

Key advantage in terms of business budgeting:

actiTIME lets you take into account multiple business resources at once: not just costs, but billable amounts and employee time. As a result, you get a more comprehensive budgeting experience than cost management alone can produce.

Disadvantage:

- actiTIME lacks advanced business budgeting functionality, like scenario-based forecasting and financial modeling.

- The free version doesn’t feature budget tracking.

G2 rating: 4.5 (35 reviews)

Pricing:

- Free 30-day trial.

- Free version with limited functionality.

- Paid plans start at $5 per user/month.

Use case:

A digital marketing agency struggled to tame the complexities of resource management when working on ad campaigns. Its projects often went over budget, adversely affecting the bottom line and straining its relationships with clients.

The agency decided to apply actiTIME to organize projects more effectively and see what’s actually going on.

Implementation process

Here’s what they did step by step:

- Created a project and broke it down into smaller tasks.

- Set estimates, deadlines, and priorities for each task and allocated work across the team.

- Set all the three types of budgets to the entire project and each task separately.

- Activated hourly pay rates for all employees and billing rates for tasks to enable actiTIME to calculate work-related costs and billable amounts automatically.

- Started to track working time during the course of the project and check their budget usage daily via the visual progress bars.

- Each month, they evaluated their performance data in greater detail using actiTIME reports.

End result

The agency managed to find out what caused those annoying overruns:

The initial time estimates for some tasks (e.g., campaign planning, client meetings, mockup revisions, etc.) were inadequate – employees ended up investing much more time in working on them. Thus, the overall cost for billable and non-billable tasks increased multifold, making it impossible to stay on budget and within the sum the agency’s client agreed to pay for the campaign.

Using actiTIME data and plentiful visual progress tracking tools, the agency managed to reduce its overspending and then used the collected data to improve estimation accuracy in next projects. Over the following year, the overall rate of overspending within the agency decreased to none.

2. Abacum

Key features:

- Revenue planning

- OpEx planning

- Headcount planning

- Investor reports

Abacum is an intuitive and largely automated software for financial planning and analysis (FP&A) that allows you to take into account headcount costs, operational expenses, and project revenues.

You can implement custom scenarios to assess risks and forecast future outcomes with easy-to-understand models.

Moreover, Abacum allows you to plan your resources collaboratively with key stakeholders. And as this case study suggests, collaborative budgeting helps to create more realistic and achievable budget documents that promote financial stability and investor confidence.

Best for:

Automated financial planning for scaling companies.

Key advantage in terms of business budgeting:

You can see how feasible and realistic your budget estimates are in different scenarios and minimize the risk of cost overruns.

Disadvantages (based on users’ reviews):

- Pre-built templates for modeling and reporting are somewhat limited.

- Since Abacum is rather new business budgeting software, it still lacks some essential functionality.

G2 rating: 4.8 (106 reviews)

Pricing:

Contact the Abacum team for pricing info.

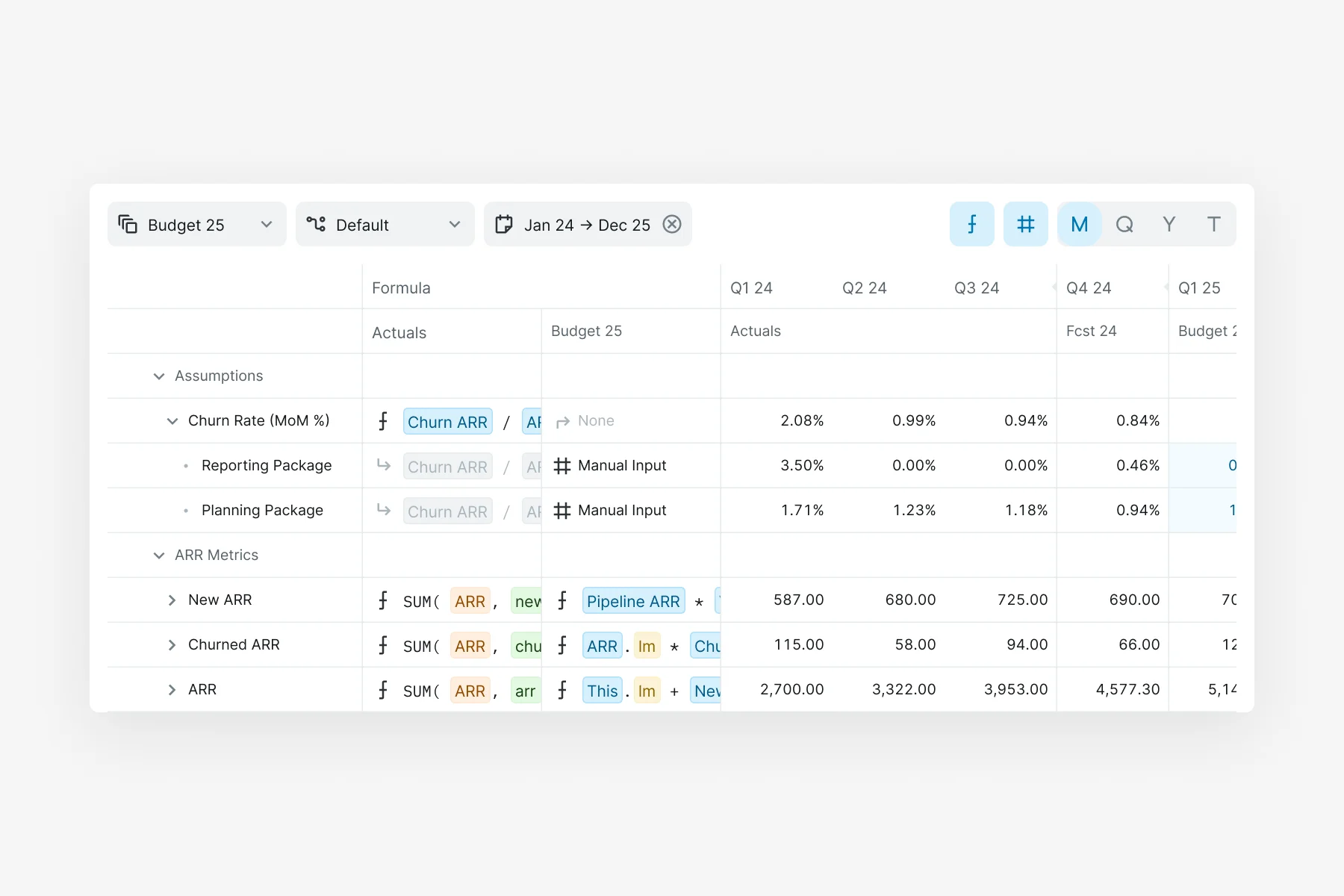

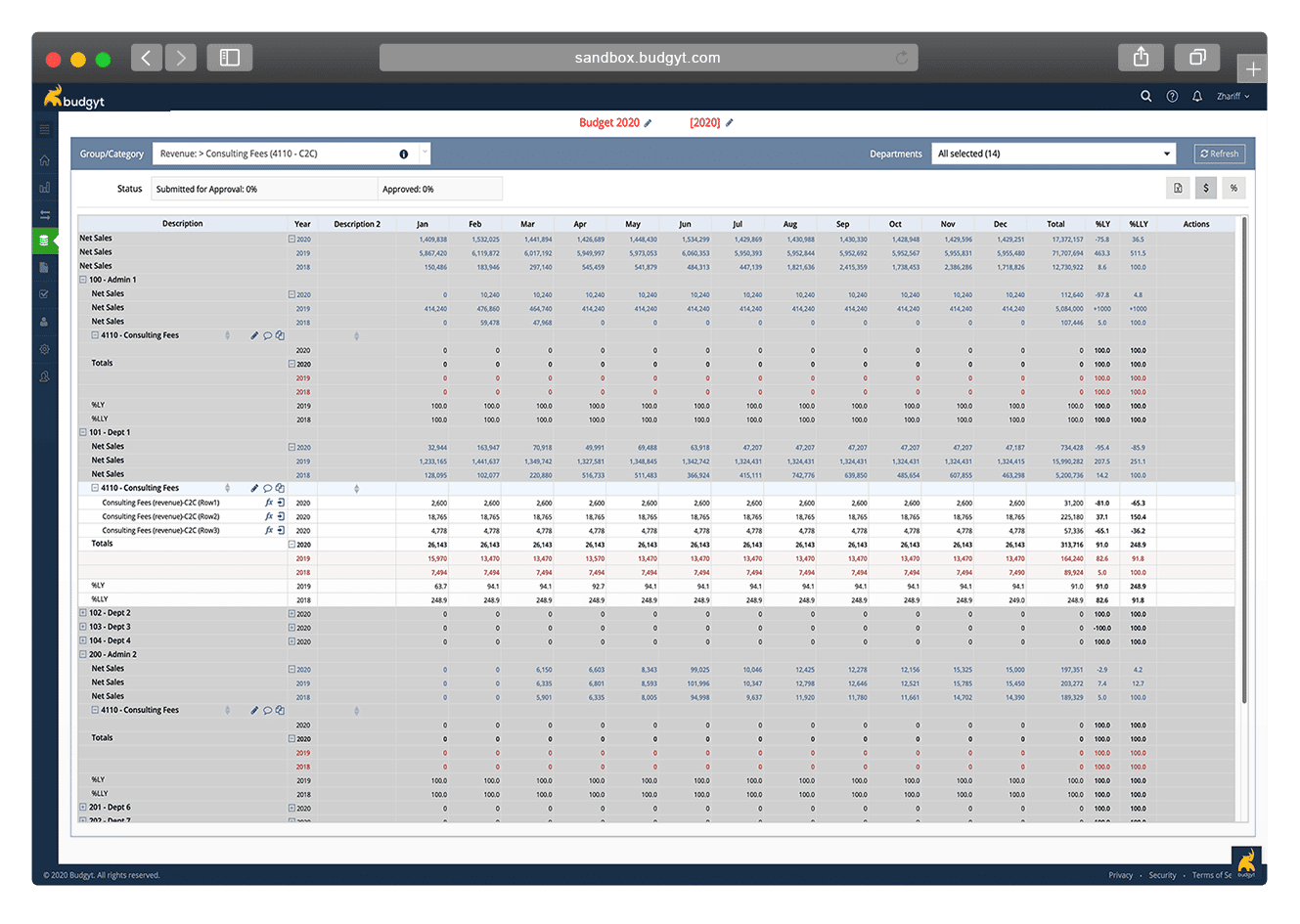

3. Budgyt

Key features:

- Team-based business budgeting

- Multi-currency reports

- Visual data analysis

- API connector

Budgyt is a reliable and intuitive business budgeting solution, that makes it super easy to navigate through all your financial data and countless formulas.

It helps to build accurate well-structured reports automatically and export them to Excel or CSV in a matter of seconds. It empowers your team to collaborate on budgets across departments and ensures 100% secure data management thanks to multi-level user permissions and activity logs.

This way, Budgyt helps even large organizations to overcome the shortfalls of conventional budgeting (with its overly narrow focus, centralized decision-making, and a rigid approach) by allowing for a more simple and flexible planning process.

Best for:

CFOs in medium-sized and large companies with multiple departments.

Key advantage in terms of business budgeting:

Budgyt formulas are flexible and built to accommodate to structural changes within teams. They are perfect for collaborative budgeting across multiple departments.

Disadvantages (based on users’ reviews):

- Integration options are rather scarce.

- Steep learning curve (for those not used to financial modeling).

G2 rating: 4.8 (75 reviews)

Pricing:

Contact the Budgyt team for pricing info.

4. Centage

Key features:

- Scenario planning

- Workforce planning

- Collaborating budgeting

- Reports

As it’s fairly noted by Francois Botha, Excel has been used so widespredly by businesses around the world that its name is now synonymous to spreadsheets. And though it’s still a life-saving tool for small family businesses, most companies need more serious solutions to meet their data management demands.

Centage positions itself as an efficiency-boosting alternative to Excel. It simplifies business budgeting thanks to robust collaboration features and centralized data management that doesn’t require users to have any advanced knowledge in order to achieve quick and accurate results.

Best for:

Small businesses in financially risky industries (i.e., construction).

Key advantage in terms of business budgeting:

Centage uses the driver-based planning model that helps you create budgets and allocate resources in a way that maximizes your value and boosts the most important aspects of your business.

Disadvantages (based on users’ reviews):

- Steep learning curve.

- Data uploading and processing can be slow.

G2 rating: 4.3 (22 reviews)

Pricing:

Request a quote from the Centage team.

5. Cube

Key features:

- AI-generated scenarios

- Familiar spreadsheet interfaces

- Custom formulas

- Multiple integrations

Cube helps to navigate through heaps of spreadsheets and analyze bewildering amounts of data. It integrates with familiar tools like Excel and Google Sheets, which makes the learning curve pretty much non-existent, while plentiful automation tools streamline and speed up the budgeting process even more.

Take AI-driven forecasting as an example.

This feature analyzes your historical data, automatically figures out what went wrong or well, and provides a precise picture of your financial performance to inform your future decision-making.

As predicted by Gartner, about 50% of businesses will apply AI to substitute complex and lengthy bottom-up forecasting process by 2028. So, why not stay ahead of the curve and try it out now?

Best for:

Dedicated Excel and Google Sheets users looking for advanced business budgeting functionality.

Key advantage in terms of business budgeting:

You can build custom models and formulas that align with your needs just perfectly.

Disadvantages (based on users’ reviews):

- Data processing can be time-consuming.

- Visuals are not intuitive enough.

G2 rating: 4.5 (117 reviews)

Pricing:

Starting at $2,000 per month.

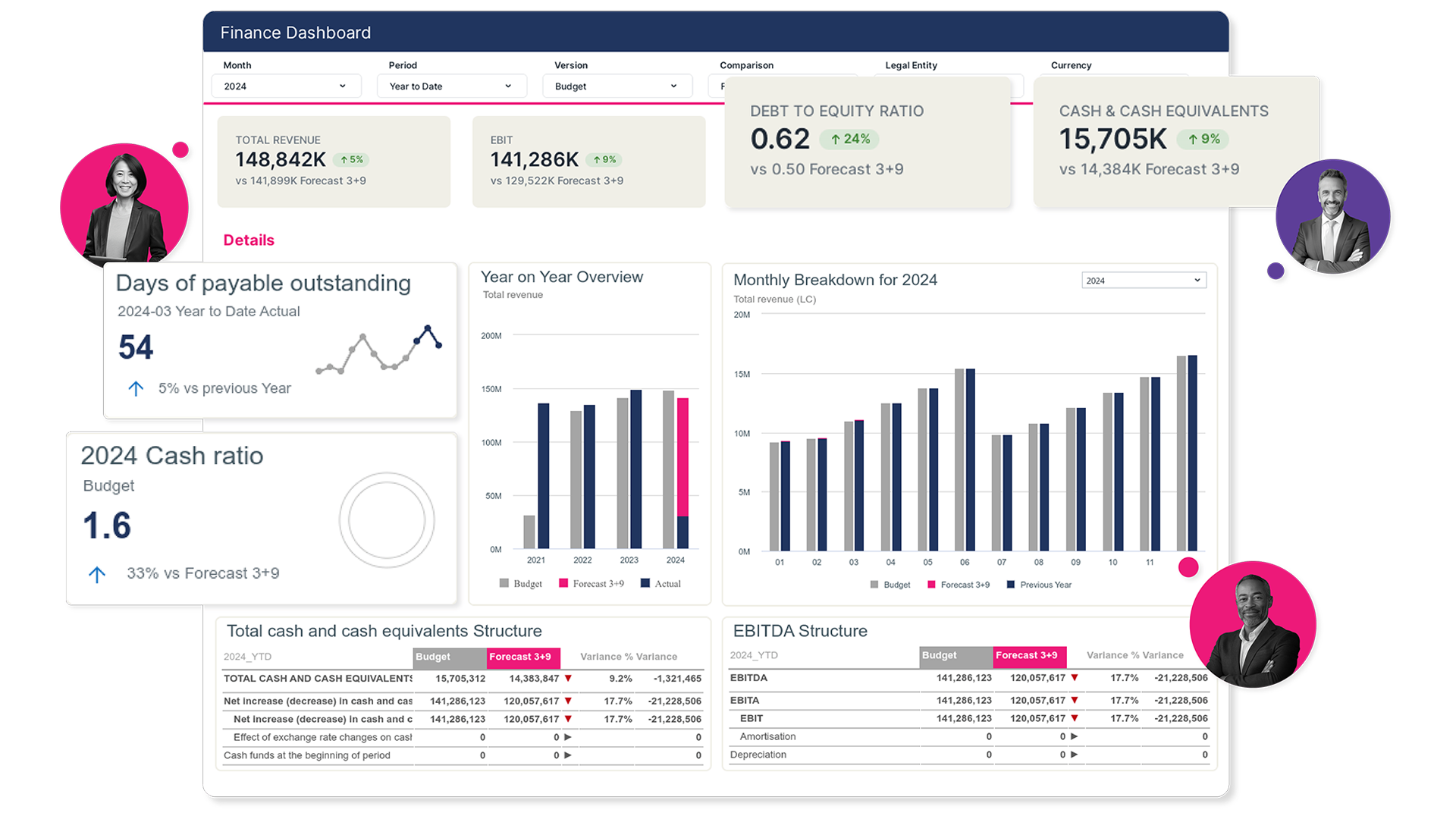

6. Jedox

Key features:

- Excel-like interface

- AI-driven forecasting

- Cash flow planning

- Revenue planning

Jedox lets you break free from the limitations of traditional spreadsheets without giving up the convenience of the Excel experience.

It offers:

- A bunch of visual tools that simplify the analysis process.

- All the must-have reports for accurate financial planning, like Profit vs. Loss, Balance Sheets, and Cash Flows.

- AI-driven forecasting feature that uses data from multiple sources and turns it into clear, actionable insights.

As an experienced CFO, Kurtis Hanni, fairly states in his recent piece, accounting work is slow work:

“…when preparing financials, we want to make sure they’re right. We review transaction data, reconcile accounts, and then do our analysis before passing them on. But now, much of that will be able to be automated, meaning financials are produced in the snap of a finger.”

Using Jedox’s AI-powered automation, you can definitely speed up your accountants and let them focus on higher-value tasks.

Best for:

Large companies looking to boost their budgeting efficiency.

Key advantage in terms of business budgeting:

Jedox takes pride in its AI functionality. It simplifies the analysis of hypotheses and provides users with crystal-clear visual representations. On top of that, you can use it as a chatbot – just ask a question and get answers in simple human language, turning complex data into something truly easy to understand.

Disadvantages (based on users’ reviews):

- Difficult to understand for inexperienced users.

- Not flexible enough.

G2 rating: 4.4 (174 reviews)

Pricing:

Get a quote from the Jedox team.

| Abacum | Budgyt | Centage | Cube | Jedox | |

| AI tools | |||||

| Collaborative budgeting | |||||

| Driver-based planning | |||||

| Sales and revenue planning |

7. Jirav

Key features:

- Driver-based modeling

- Cash flow forecasting

- Long-term budgeting

- Integrations

Jirav combines intuitive spreadsheets, visual dashboards, and automated projections within a single business budgeting platform.

It features just everything you might need:

- Reporting tools to compare your initial budget estimates to actual outcomes.

- Customizable tables, templates, KPIs, and whatnot!

More importantly, Jirav supports driver-based scenario planning. According to a recent AFP study, this approach is proven to make your decision-making more agile and proactive since it’s based on a broader understanding of the cause-and-effect relationships affecting your financial performance.

Best for:

Accounting firms + small and medium-sized businesses.

Key advantage in terms of business budgeting:

Users rave about Jirav’s easy-to-use interface. And let’s be honest, UX simplicity is a big deal for any business budgeting software – nobody wants to spend hours navigating through cluttered and incomprehensible interfaces when there are serious numbers to crunch.

Disadvantages (based on users’ reviews):

- Model building is time-consuming at first.

- Jirav lacks revenue-based forecasts per item.

G2 rating: 4.7 (182 reviews)

Pricing:

Starting from $30 per month.

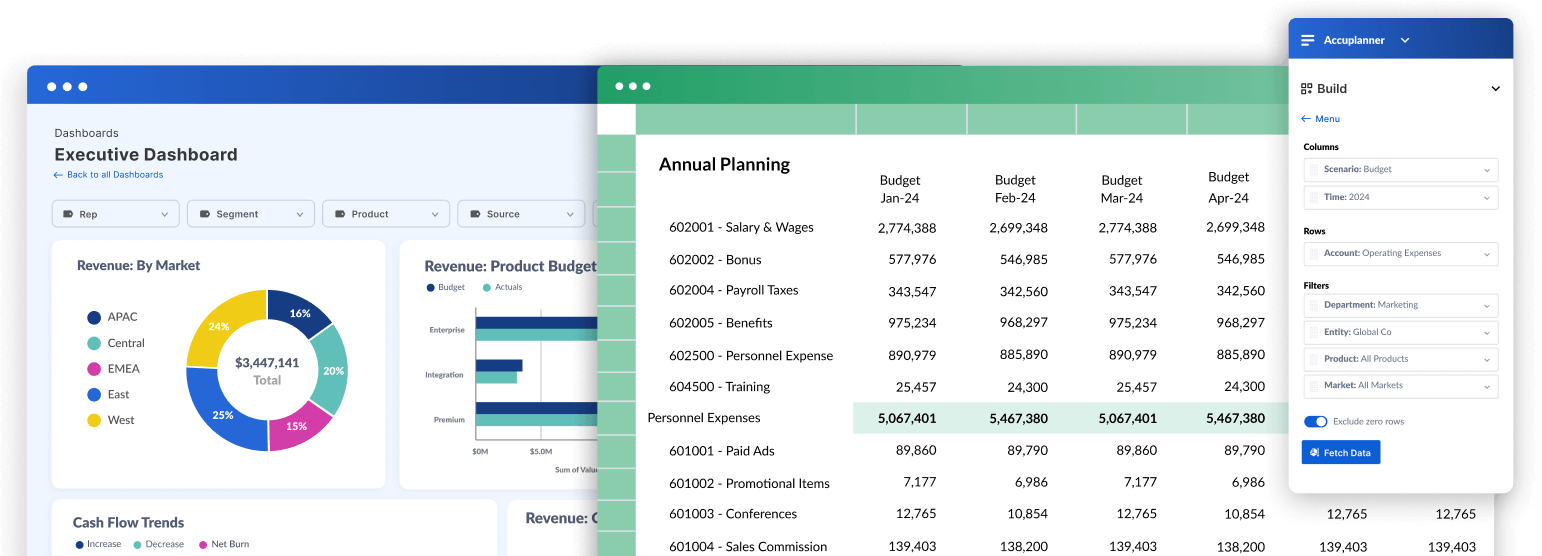

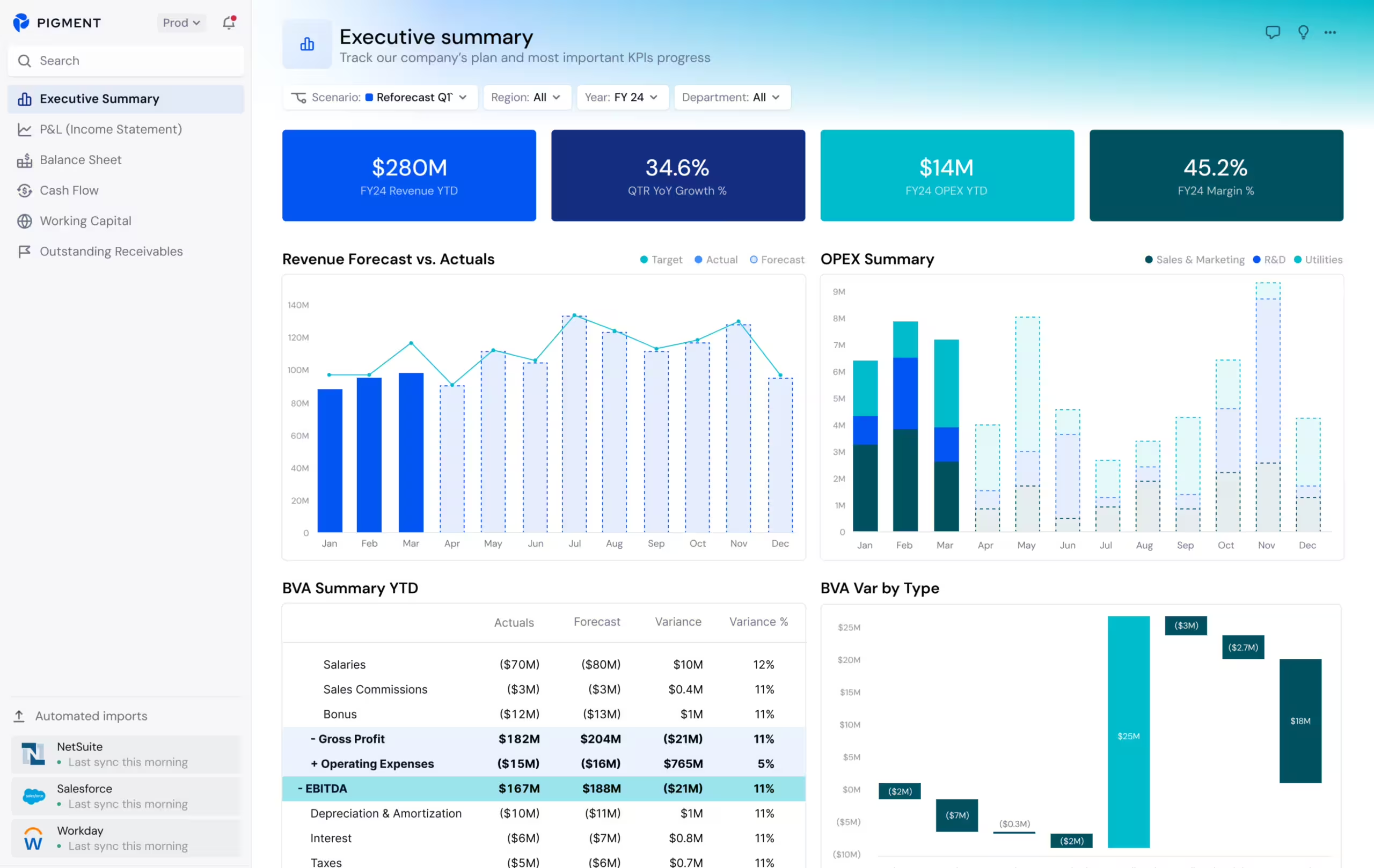

8. Pigment

Key features:

- Budget variance analysis

- Collaborative planning

- Sales forecasting

- AI tool

Whether you’re looking to predict next quarter’s revenue or plan how to allocate your business resources in the long run, Pigment offers an intuitive and visually engaging way to bring your financial data to life.

It automates virtually any budgeting process you can think of: from autocompleted formulas to API-supported data import and export. Besides, it features an AI tool to make your work a lot easier – use it to:

- Speed up forecasting.

- Obtain fast insights and summaries of complex data.

- Get modeling shortcuts and other type of guidance you might need.

Best for:

Enterprises with advanced budgeting needs.

Key advantage in terms of business budgeting:

By integrating diverse data sets from different business departments, Pigment fosters a comprehensive, strategic approach to resource management – perfect for long-term planning and large-scale decision-making with the focus on value delivery.

Want to learn how to maximize ROI by means of effective resource management? Check out our interview with Mike Clayton, a project management guru who has all the answers you need.

Disadvantages (based on users’ reviews):

- Since Pigment is a new software solution, it’s still under development.

- Processing large data sets takes time.

G2 rating: 4.6 (80 reviews)

Pricing:

Get a quote from the Pigment team.

9. PlanGuru

Key features:

- Flexible budgeting

- Financial statements

- Scenario analysis

- Forecasts for up to 10 years

PlanGuru is a solid business solution with all the essential features – not more, not less.

First, it helps you to crunch numbers and, then, interpret them thanks to three vital financial statements (balance sheet, income statement, and cash flow report) and data visuals that promote reliable, evidence-based decision-making.

Best for:

Small businesses and business advisors.

Key advantage in terms of business budgeting:

PlanGuru is power-packed with 20+ forecasting methods that let you approach financial modeling from multiple angles and get the most accurate forecasts.

Disadvantages (based on users’ reviews):

- The learning curve is steep for inexperienced users.

- Some interfaces feel a bit clunky.

G2 rating: 4.5 (37 reviews)

Pricing:

Starting from $83 per month.

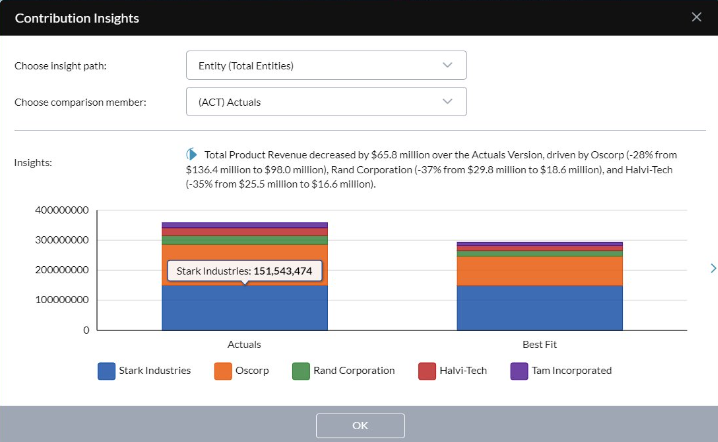

10. Prophix

Key features:

- Automated budgeting

- Team collaboration

- Intuitive model building

- Custom workflows

Prophix is an all-in-one financial management platform that helps to plan and track a variety of resources, including operational costs, workforce expenses, project revenues, and more.

Using Prophix, your team can collaborate on budgets across departments, while custom approval workflows and multi-level user permissions allow you to keep your data securely locked from those who are not supposed to see it.

Best for:

Large enterprises with multiple departments.

Key advantage in terms of business budgeting:

Prophix is highly flexible. It lets you build custom models, formulas, and workflows that suit your needs and ways of working just perfectly.

Disadvantages (based on users’ reviews):

- The interfaces are not intuitive enough.

- Data sorting and filtering options could be improved.

G2 rating: 4.4 (188 reviews)

Pricing:

Get the quote from the Prophix team.

| Jirav | Pigment | PlanGuru | Prophix | |

| AI Tools | ||||

| Collaborative budgeting | ||||

| Driver-based planning | ||||

| Sales and revenue planning |

Conclusion

Business budgeting can sometimes feel like a guessing game, but with the right software in your toolkit, taming those rogue expenses and maximizing your revenues becomes as easy as pie.

Any of the above solutions can largely simplify your budgeting process and boost your financial confidence. However, most of them come with a hefty price tag.

So, if you’re not ready for big investments yet need a reliable solution to prevent overspending, ensure effective resource allocation, and get a real-time view of your financial roadmap, then give actiTIME a try!

It fosters a comprehensive and flexible approach to budget tracking, empowering you to deliver high-quality work without the stress of unexpected expenses.

Sign up for a free actiTIME trial to replace your cost concerns with reliable and efficient resource management.