What is business accounting, and why is proper accounting important in every business? Accounting maintains an accurate and comprehensive report of all business transactions of a company. Accounting is vital in small businesses as it assists owners, managers, and other stakeholders in making financial decisions. 🧠

With small business accounting software, most accounting operations are automated, eliminating the need for hiring professional accountants. Not every small business owner has the knowledge or expertise to perform accounting operations accurately. However, many software programs and platforms exist to serve your accounting needs. Here, we listed the best small business accounting software you can find on the market today.

Best Small Business Accounting Software in 2022

1. actiTIME

Key features:

- Payroll calculation

- Billable time tracking

- Automatic invoicing

- Cost and profit reports

actiTIME is a timesheet tool, yet it offers quite an extensive array of accounting features for small businesses. With its help, you can collect all the essential pre-accounting data, including the information on billing time and working time of your employees, for consequent invoicing and payroll calculation. 💰

In addition, actiTIME allows for an easy analysis of project costs and revenues, which facilitates the budgeting process. Overall, actiTIME is the ideal software if you are looking to manage your business productivity and perform accounting operations in one centralized platform.

Platforms: The tool is available as both a cloud solution and a self-hosted package.

Pricing: actiTIME offers a fully functional 30-day online trial and has a free version for 1-3 users with limited functionality. The paid version of actiTIME Online will cost you $5-7 per user a month. As for the self-hosted version, it costs $120 per user.

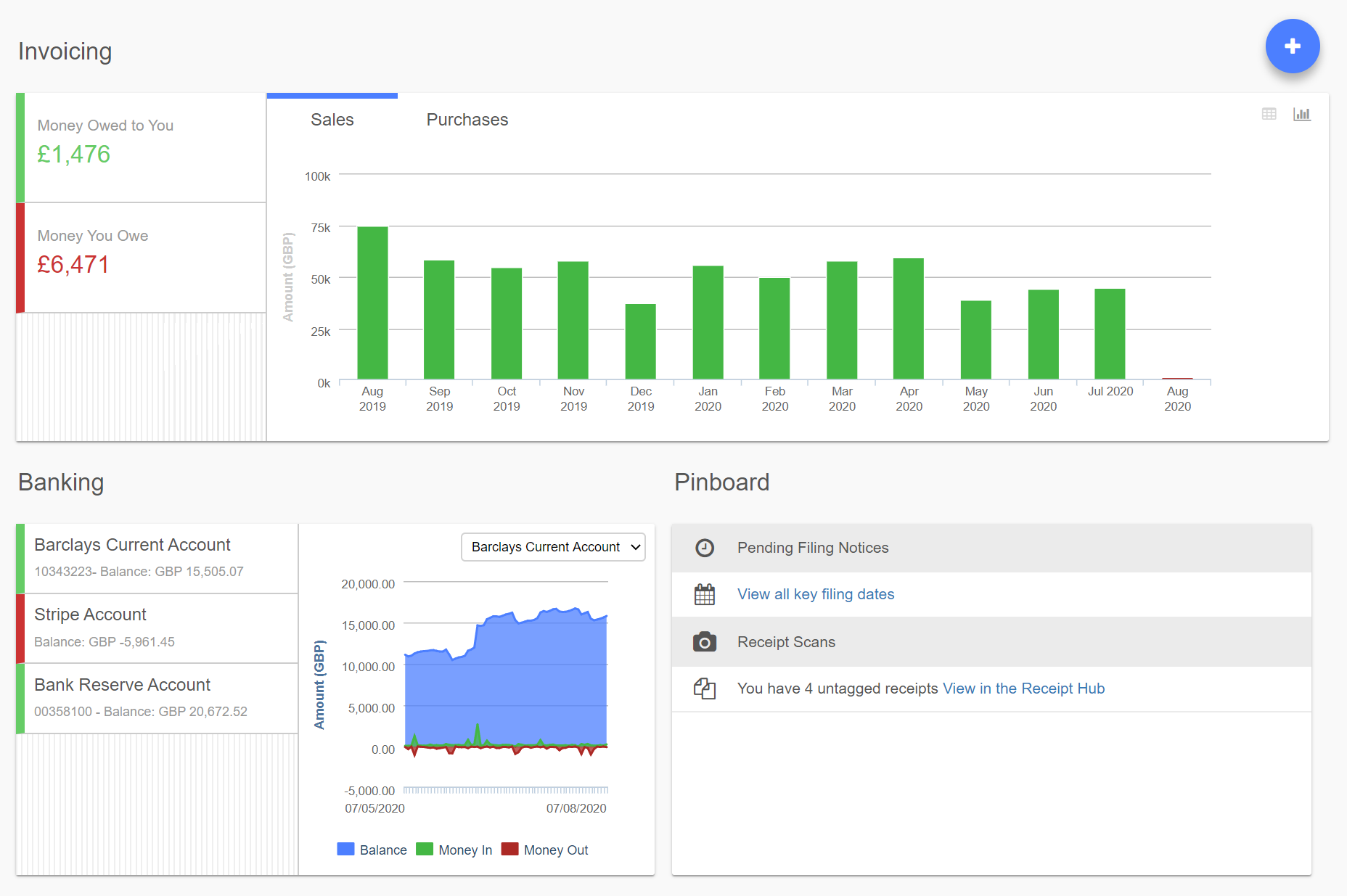

2. QuickFile

Key features:

- Customizable invoices

- Automated bank feeds and reconciliation

- Invoice reminders

QuickFile is cloud-based small business accounting software. It provides an array of accounting capabilities, including professional invoicing, expense management, Value Added Tax (VAT), and bank feeds. In addition to all the excellent accounting features, QuickFile serves as a fully branded portal where your clients can view and pay their invoices. It offers multi-currency support covering sales, purchases, and foreign currency bank accounts. 💱

Platforms: Web-based, cloud, SaaS, mobile (both iOS and Android).

Pricing: There’s a free version with limited functionality for small to medium-sized accounts. For the paid QuickFile version, pricing starts at £45 + VAT a year. You can try this piece of software out during a fully functional 30-day online trial.

3. Gekko

Key features:

- Online invoice editor

- Mobile invoicing

- Manual time tracking

- Expense tracking

Gekko is a freemium invoicing and small business accounting software designed for small business owners and aspiring entrepreneurs. With Gekko, you can easily send invoices, track your hours, register your receipts and monitor your work trips. This tool is a perfect match for those who like mobility – it helps you run your business whenever and wherever you want. 📱

Platforms: Web-Based, cloud, SaaS, mobile.

Pricing: Gekko has a free basic version with limited features for small businesses. The premium pricing starts at €12 per month. A fully functional free trial is also available.

4. billfaster

Key features:

- Sales invoicing

- Financial reports

- Tax compliance

- Multi-user permissions

billfaster is simple accounting software for small businesses. It promises a unique user experience by providing an interface that reduces time spent on paperwork and bookkeeping by 80% with quick and straightforward entry screens. With billfaster, you can access your information at any time. The instant, up-to-date financial reports created with the app can help you track money in and out of your business to maintain a healthy cash flow. 💸

Platforms: Mac OS, Windows OS, Web-based, cloud, SaaS, mobile.

Pricing: billfaster pricing starts at $25 per month. It doesn’t offer a free version, but a 30-day free trial is available.

5. Melio

Key features:

- Online payments

- Invoicing

- Team management

- Integrations

Melio is small business accounting software that streamlines your payment operations. It allows you to generate invoices automatically, pay vendors and receive international payments from clients in an effortless and centralized way. Besides, it’s possible to integrate Melio with QuickBooks for a more streamlined accounting process.

Platforms: Mac OS, Windows OS, Web-based, cloud, SaaS, mobile.

Pricing: Melio charges disparately for different types of transactions. For example, receiving a bank transfer from clients will cost your business nothing at all, but instant payouts come with a 1% fee.

6. LedgerLite

Key features:

- Double-entry bookkeeping

- Unlimited accounts and cashbooks

- Automatic tax calculations

LedgerLite is a piece of small business accounting software offering bookkeeping services. With this tool, you can reconcile your cash books with your bank statements. Besides, you can import CSV data into your cashbook and export data in CSV format to other programs such as Excel.

LedgerLite’s ease of use makes it the best for small business accounting. If you need software with double-entry bookkeeping features, you will find that LedgerLite is a perfect blend of price, reliability, and convenience. ⚖️

Platforms: Windows OS (no installation, database configuration, or Internet connection is required).

Pricing: LedgerLite registration costs $99. This registration fee is a one-time payment with no additional charges.

7. Fiskl

Key features:

- Expense and time tracking

- Mobile invoicing

- Payment processing

- Quote management

Fiskl is small business accounting software that allows you to manage finances on the go. It is simple, intuitive and built with mobility in focus. Fiskl is widely used by small businesses locally and internationally to make sense of their finances, boost productivity and drive their business forward. 📈

This piece of software allows for creating and converting quotes into invoices. Plus, you can use the automated time tracker and see precisely how much time you’re spending on projects in order to bill clients and calculate payroll.

Platforms: Web-based, cloud, SaaS, mobile.

Pricing: Fiskl pricing starts at $14 per user a month (billed annually). It has a free version with limited functionalities. There’s no free trial.

8. HostBooks Accounting

Key features:

- Bank reconciliation

- Expense tracking

- Billing and invoicing

- Fixed asset management

HostBooks is a piece of cloud-based accounting software that helps small business owners to overcome accounting challenges. It aims to reduce the time and effort spent on compliance and bookkeeping and features accounts receivables, business tax accounting, payroll, project accounting, and CPA services. 📒

Platforms: Web-based, cloud, SaaS.

Pricing: The pricing starts at $15.99 per user a month. There is a free version with limited functionalities. Plus, HostBooks Accounting offers a free trial.

9. SumUp

Key features:

- Invoicing

- Portable data with API

- Automatic bank reconciliation

SumUp is small business accounting software where you can easily create and send professional-looking invoices and know the moment your customer views your invoice. The automatic bank reconciliation feature makes it easy to match your invoices and expenses with your bank transactions. Besides, with SumUp, you can organize your expenses and get a comprehensive overview of cash flows in your business. 📊

Platforms: Web-based, cloud, SaaS, mobile.

Pricing: SumUp charges users 2.90% + $0.15 fee per invoice, which your customers will pay online through the payment link. There is no free version, yet SumUp offers a free trial.

10. Osome

Key features:

- Taxes

- Bookkeeping

- Incorporation services

- Reports

Osome is a premium accounting SaaS for Singapore, Hong Kong, and UK businesses. Their accounting packages are tied to your revenue, and you have to pick a monthly plan to receive regular financials or an end-of-the-year catch-up accounting to submit neat reports. They also offer incorporation services, helping you unravel your e‑commerce ambitions and set up your company in Singapore. 🦁

Platforms: Mac OS, Windows OS, Web-based, cloud, SaaS, mobile.

Pricing: from S$350.

11. QuickBooks

Key features:

- Expense tracking

- Invoicing

- Cashflow management

- Reports

One of the most popular small business accounting software, QuickBooks allows users to manage sales and expenses and keep a record of daily transactions. QuickBooks automates invoicing, billing, payroll accrual, tax filing, and many other accounting tasks. It is incredibly safe to use since it has bank-level data encryption to ensure users’ data is always secure. Besides, automatic backups on the cloud take place regularly. ☁️

Platforms: Web-based, cloud, and SaaS.

Pricing: QuickBooks offers a free 30-day trial on several plans, ranging in cost from $15 up to $100 per month. Payroll and payment services attract additional charges.

12. Kashoo

Key features:

- Automated invoicing

- Payroll

- Advanced reports

- Income and expense tracking

Kashoo is simple small business accounting software. However, regardless of its simplicity, it offers some handy features for advanced and streamlined accounting. Using Kashoo, you can automate the entire invoicing process, track your income and costs, calculate payroll and collect payments. Plus, the tool lets you run versatile reports to inform your decision-making and analyze your financial performance in depth. 🏊♀️

Platforms: Web-based, SaaS, mobile.

Pricing: Kashoo has a free invoicing tool for very small businesses. A fully-equipped accounting solution will cost you $20 a month, while the solution for advanced accounting will cost $30 a month.

13. ZarMoney

Key features:

- Billing

- Estimates

- Reports

- Online payments

ZarMoney is an affordable accounting solution for businesses of any size, from solo entrepreneurs to large international enterprises. It offers a set of robust features for managing virtually all your accounting tasks in one place. You can use it to generate professional-looking invoices in several clicks, send quotes to your customers and easily collect payments from them. Plus, ZarMoney helps you boost collaboration in your accounting team thanks to such valuable features as automatic notifications and built-in messages. 🔔

Platforms: Web-based, cloud.

Pricing: ZarMoney has three pricing plans: Entrepreneur, Small Business and Enterprise. The price for the first is only $15 a month (per user). And the second plan will cost you $20 a month, which covers merely two users (each additional user account can be purchased for an extra $10 a month).

14. ZipBooks

Key features:

- Invoicing

- Accounting

- Business intelligence

- Cost management

ZipBooks is time and billing software for accountants. It helps users to track expenses and generate reports that can be used for tax purposes and in-depth business analytics. The software makes it easy for businesses to manage their finances and make sure that all of their financial data is kept in one place. This way, ZipBooks allows for saving time and money, and that’s what makes it such a popular choice for small companies. ⭐

Platforms: Web-based, cloud, mobile devices.

Pricing: ZipBooks offers a free version with limited functionality, and the price for paid plans starts at $15 a month (for up to 5 users). A free trial period is available as well.

15. Lendio

Key features:

- Invoicing

- Accounting

- Business intelligence

- Cost management

Lendio is simple-to-use accounting software with a variety of efficiency-boosting features. For example, it allows businesses to track income and expenses, manage payroll, process payments, run informative reports, and create invoices in just a few clicks. In addition, Lendio provides users with access to lending institutions, allowing them to secure loans more easily. 🤑

Platforms: Web-based, cloud, mobile devices.

Pricing: Lendio has a free version and a paid plan that costs $19.99 per month. You can check out the software for free during a 14-day trial.

Conclusion

Running a business is hard enough – you shouldn’t have to do your own accounting on top of everything else. That’s where small business accounting software comes in. It can save you time, money, and headaches by automating tasks like invoicing, tracking expenses, and managing your finances.

In this roundup, we reviewed 15 of the best options available, so you can find the perfect fit for your business. No matter what size or type of business you run, there’s an accounting solution out there that will help you save time and better manage your finances – so you can focus on running your business instead of numbers-crunching.