Managing payroll is something every business has to deal with, whether you’re running a big corporation or a small startup. But let’s be real—this is also where mistakes can sneak in pretty easily.

These slip-ups can mess with how much employees get paid, throw off tax calculations, and even lead to issues with labor laws. We’re talking about everything from simple math errors to complicated problems with classifying employees or managing benefits.

No matter what type of mistake, payroll blunders can hit the business and its employees hard. So, we thought it’d be a good idea to dive into some of the most common payroll pitfalls and how to dodge them.

Top Six Payroll Blunders and Their Hidden Costs

Incorrect Employee Classification

First up, we have employee classification, which is all about figuring out if someone is an employee or an independent contractor. This distinction is super important because it affects how workers are paid, what benefits they get, and how taxes are taken out.

You’d be surprised at how many businesses don’t really know the rules around this or even misclassify employees on purpose to save some cash on payroll taxes and benefits. High turnover can make things even messier—when new managers come in, they might not know who’s who.

The fallout from misclassifying employees can be pretty severe. We’re talking hefty fines from the IRS or state tax folks, legal battles that could cost a fortune, and a damaged reputation that makes it tough to attract great talent in the future.

Sample Scenario

A company brings on a graphic designer as a contractor to cut costs on benefits. But this designer is working full-time hours, sticking to a set schedule, and using company gear. If things go south, that designer could miss out on benefits they should’ve received as a full-timer, leading to a potential lawsuit over unpaid benefits and overtime.

How to Tackle the Issue?

- Stay updated on federal and state labor laws about employee classification. Regularly check out IRS and Department of Labor guidelines to stay compliant.

- Make sure you have clear job descriptions that lay out roles, responsibilities, and expectations. Keep info about project costs and pay rates accessible for HR and managers.

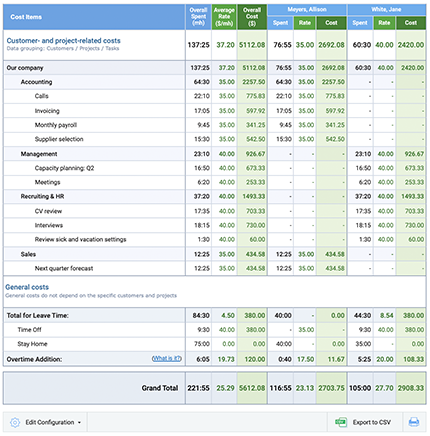

For instance, tools like actiTIME let you customize costs for specific tasks and pay rates for individual employees, helping ensure accurate billing and payroll.

- Conduct regular audits of employee classifications in your organization. Spot any discrepancies and fix them quickly to avoid potential headaches.

Encourage open communication between hiring and payroll teams so everyone knows the classification criteria and why they matter.

Inaccurate Time Tracking

Next up is inaccurate time tracking. This might seem like a minor detail, but it can spiral into all sorts of problems that affect payroll, employee morale, productivity, and overall business operations—and trust me, it happens more often than you think!

A lot of businesses still use old-school methods like paper timesheets or spreadsheets for tracking hours. Human error is bound to happen in these setups, leading to discrepancies in reported hours.

Employees might not know how to accurately log their hours worked, especially if they’re new to time tracking software or procedures. Sometimes they might not even know how to log their hours at all!

This can lead to violations of labor laws around overtime and minimum wage requirements. Plus, inaccurate time tracking can result in overpayments or underpayments, leaving employees frustrated and unhappy—which can hurt productivity and increase turnover rates.

And without solid data on employee hours, management might struggle to allocate resources effectively, making business decisions based on faulty info.

Sample Scenario

An employee at a manufacturing plant totally forgets to clock in and out for a few days because the time clock is acting up. The payroll team ends up estimating their hours based on what they worked in previous weeks, which leads to them getting underpaid by a few hundred bucks. Naturally, the employee feels pretty undervalued and raises a fuss about their pay being off.

How to Tackle the Issue?

- First off, let’s automate that time recording! This will help cut down on human errors. Check out tools like actiTIME that let you log hours online, calculate overtime, cost of work, and wages, and even access everything from your phone.

- Ensure everyone gets solid training on using the time tracking system. They should know the company’s policies on logging hours and feel comfortable asking questions if they’re confused.

- Also, don’t forget to do regular check-ups on time tracking records and payroll reports. Catching mistakes early can save everyone a lot of headaches later on.

- And create clear and simple time tracking policies that lay out what’s expected from employees. Keep these policies easy to find and review them regularly.

Wrong Tax Withholdings

Now, let’s talk about tax withholdings. Tax rules can be super complicated and change all the time, so it’s really important to get this right. If not, employees might overpay or underpay their taxes throughout the year.

Why does this happen? Well, sometimes employees fill out their W-4 forms with outdated or incorrect info—like their marital status or number of dependents. Plus, if the payroll team is manually entering tax info, human error can creep in, leading to wrong withholding amounts.

If your payroll staff isn’t properly trained on tax withholding rules, mistakes are bound to happen. This could mean penalties and interest charges for the company. And if you’re consistently under-withholding taxes, you might face some serious cash flow issues when it’s time to pay up to the government.

Sample Scenario

A new hire fills out their W-4 form wrong, claiming way too many allowances. Because of that, the payroll team withholds way less tax than they should. When tax season rolls around, the employee finds out they owe a big chunk of money, which leaves them frustrated and stressed out.

How to Tackle the Issue?

- Make sure employees fill out their W-4 forms correctly and remind them to update it whenever something changes in their lives (like getting married, divorced, or having a kid). Sending regular reminders can really help with this.

- Keep an eye on federal and state tax regulations to stay compliant. You might want to subscribe to updates from the IRS or work with a tax pro who can keep you in the loop about any changes.

- Invest in training for your payroll staff so they fully understand tax withholding rules and can handle any changes that come up smoothly.

Neglecting Employee Benefits

Next come employee benefits! They’re not just nice-to-haves; they cover a bunch of important stuff like salary, health insurance, retirement plans, and paid time off. These benefits are key to attracting and keeping great talent.

But managing all that can get pretty complicated and time-consuming. Sometimes, companies end up dropping the ball on benefits or not managing them well at all. When employees feel like their employer doesn’t care about their well-being, guess what? They start looking for jobs elsewhere.

So, if a company neglects employee benefits, they might find it tough to attract top talent. That puts them at a serious disadvantage compared to competitors who offer better packages.

Sample Scenario

During open enrollment, an HR manager forgets to tell employees about changes to health insurance and retirement plans. A bunch of employees miss the deadline to sign up or make changes, which leaves them unhappy and potentially missing out on benefits that could’ve really helped them financially.

How to Tackle the Issue?

- Regularly review the benefits you offer to ensure they meet what your employees want and need.

- Ensure everyone knows what benefits are available. Provide clear info on how to access them and why they matter.

- Pick HR software that makes managing and communicating about benefits easier.

Incorrect Late End-of-Year Reporting

And what about the end-of-year payroll reporting? This is when you gather and send out important stuff like W-2s for employees and 1099s for contractors to the IRS and state tax authorities.

It might seem like just another routine task, but messing this up can have serious consequences. Many businesses don’t plan well for year-end reporting, which leads to last-minute chaos and mistakes—especially when new tax rules come into play.

If reporting isn’t done right or on time, it can lead to audits from tax authorities, which are a pain and can cost a lot of money. Plus, the IRS can hit you with penalties for late or incorrect filings, and those add up fast. Employees also have a rough time filing their taxes if their W-2s or 1099s are wrong or late, which can lead to frustration and even legal headaches.

Sample Scenario

The payroll department submits year-end tax forms (W-2s) late because someone dropped the ball in the process. Employees get their forms after the tax filing deadline, which means they face penalties for late submissions. This creates a lot of frustration and hurts the company’s reputation.

How to Tackle the Issue?

- Set up a detailed timeline for year-end reporting that includes all the important deadlines. Share it with everyone involved.

- Make checklists to ensure all necessary documents are collected and reviewed before sending them off. This helps catch mistakes early.

- Before the year ends, do a thorough check of employee data to make sure everything is accurate.

Ignoring Collective Bargaining Agreements and Union Rules

Collective bargaining agreements (CBAs) are basically contracts that get hashed out between employers and unions. They cover stuff like wages, benefits, working conditions, and all the nitty-gritty about employment terms.

Now, these CBAs can be pretty complex and long-winded. Sometimes, employers don’t really get what’s in them or might not even know they exist at all!

Plus, if there’s a lot of turnover in the payroll department, it can lead to a big gap in knowledge about these agreements, which can cause some serious compliance issues.

If you mess up the terms of a CBA, it can hit you hard financially. You could end up paying back wages to employees, facing fines from regulatory bodies, or dealing with grievances filed by unions or employees. And that could spiral into expensive arbitration.

Sample Scenario

A company decides to roll out a new pay structure without checking in with the union that represents its workers. This new setup goes against existing CBAs in terms of raises and overtime pay.

The union doesn’t have it and files a grievance. Now, tensions are high between management and employees, and things could escalate into costly negotiations or even strikes.

How to Tackle the Issue?

- Encourage regular chats between management, HR, and union reps to keep everyone on the same page.

- Set up periodic check-ins to go over existing CBAs so everyone knows about any updates or changes that could affect payroll.

- Work closely with union representatives to ensure everyone understands the CBAs’ terms.

The Bottom Line

Payroll mistakes aren’t just annoying; they can lead to some serious financial and legal headaches for businesses and their employees.

Organizations can streamline their payroll process while keeping employees happy and supporting business success by staying aware of common pitfalls and taking proactive steps to avoid them.

Regular audits, ongoing training, and solid communication ensure your payroll system runs like a well-oiled machine.

Remember, putting time and resources into getting payroll right will pay off big time in the long run!