Creating professional invoices might not sound that enjoyable, but let us tell you, it’s the secret sauce for turning your hard work into tangible income.

Your invoice is a crucial touchpoint with clients. It reflects your professionalism and keeps your finances running smoothly. So, mastering the art of invoicing can make all the difference in getting paid on time and maintaining a healthy cash flow.

In this guide, we’ll walk you through the essentials of crafting invoices that look sharp, effectively communicate the value you deliver, and help you get the rewards you deserve.

Let’s dive in!

What Are Professional Invoices?

A professional invoice is essentially a detailed bill that outlines the services or products someone provided and the amount due.

Think of it as a handshake at the end of a deal but with numbers and paper. Plus, a well-crafted invoice doesn’t just request payment politely – it helps your business build a sense of professionalism and trustworthiness.

In the end, professional invoices aren’t just about getting paid – they’re about making a lasting impression and setting the tone for future business relationships.

7 Main Types of Professional Invoices

1. Standard invoice

This is your go-to, all-purpose invoice. It includes basics like the service provided, the amount due, and the due date. It’s versatile and can be used by freelancers, small businesses, or even larger firms. If you’re a graphic designer, web developer, or any service provider, this one is your bread and butter.

2. Pro forma invoice

A pro forma invoice is a friendly “heads-up” for your client. It’s not a final bill but rather an estimate of what the costs will be once the sale is confirmed.

This type is ideal for project-based work where the final amount might vary, such as in construction or freelance writing, giving clients a transparent preliminary look at potential charges.

3. Recurring invoice

If you’re in a business where you provide ongoing services over an extended period of time – like a subscription box company, a digital marketing agency, or even a SaaS provider – recurring invoices are your best friends. They imply a continual and consistent billing process, ensuring you get paid on a regular schedule without the hassle.

4. Credit invoice

Sometimes you need to correct an error or issue a refund, and that’s where the credit invoice comes into play. This is perfect for online retailers or any service where adjustments might be necessary. It helps keep your books clean and your clients happy.

5. Debit invoice

On the flip side of the credit invoice, a debit invoice is used to notify your client of additional charges. Suppose you’re a contractor and there were unforeseen expenses, or you’re in event planning, and the scope of work expanded. This invoice helps you communicate those changes clearly.

6. Timesheet invoice

Ideal for freelancers or consultants who charge by the hour, a timesheet invoice details the hours worked along with the rate. If you’re a lawyer, consultant, or any professional billing by the hour, this helps you show exactly where that time went.

7. Past-due invoice

No one likes to think about it, but sometimes clients need a little nudge. A past-due invoice is a polite reminder that payment is overdue. It’s commonly used in every industry but is particularly important for businesses heavily reliant on cash flow like small shops or startups.

What to Include in Your Professional Invoice?

- Header and your information: Start with your business name or your name if you’re a freelancer, followed by your contact information, including address, phone number, and email. This ensures the client knows exactly who the invoice is coming from.

- Client information: Below your details, add your client’s contact information. Addressing it specifically to the right person or department can expedite the payment process.

- Invoice number: Every invoice should have a unique identifier. This number helps both you and your client keep track of payments and can be useful for referencing previous work.

- Date of issue and due date: Clearly state the date when you are issuing the invoice and, crucially, when the payment is due. Standard practice is often 30 days, but this can vary depending on your agreement with the client.

- Description of services or products: Provide a detailed breakdown of what you are charging for. Be specific – include quantities, rates, hours worked, and any other relevant details. This transparency helps avoid any confusion or disputes later on.

- Total amount due: Boldly highlight the total amount owed. This should include an itemized tally of all charges so that the client knows exactly what they are paying for.

- Payment terms and methods: Specify how you expect to be paid. Whether it’s through bank transfer, PayPal, or another method, providing several options can make the process smoother. Also, mention any late fee policies if applicable.

- Thank you note: Adding a simple note of appreciation can leave a positive impression and encourage prompt payment. Something as simple as “Thank you for your business!” can go a long way.

Professional Invoices: What’s the Point?

As we already said, professional invoices aren’t just about getting paid – they’re about setting the stage for a more efficient, credible, and thriving business:

- Enhanced professionalism: A well-crafted invoice shows clients that you mean business. It sends a message that you are organized, reliable, and serious about your work.

- Accurate record keeping: Professional invoices provide a paper trail of all transactions. This is crucial for bookkeeping, tax preparation, and keeping track of your business’s financial health.

- Time-saving: Using invoicing software or templates reduces the time you spend preparing invoices. This leaves you with more time to focus on what you do best—running your business.

- Fewer disputes: Clear, detailed invoices leave no room for confusion, making it easier for clients to pay you on time. Besides, by itemizing the services provided and the corresponding costs, a well-crafted invoice helps prevent misunderstandings and disputes with clients.

- Legal protection: Invoices act as legal documents, proving that specific services or products were delivered and outlining the agreed-upon payment terms. This can be invaluable if any legal issues arise.

- Better client relationships: Transparency and professionalism in your billing process can foster trust and improve your relationships with clients. Happy clients are more likely to be repeat clients.

Use actiTIME to Create Professional Invoices with Ease

Professional invoices facilitate timely payments. They help to maintain a healthy cash flow and grow your business.

By ensuring accuracy, clarity, and professionalism in your invoices, you pave the way for smoother transactions and more reliable income. However, let’s face it – manual invoicing can be a real pain and distract you from what you do best.

That’s where automation comes in!

With actiTIME, you can streamline the whole invoicing process, save a lot of time, and minimize the risk of errors. This smart software solution allows you to reclaim more resources to focus on your core business needs, with the peace of mind that your invoices are being handled in a truly efficient way.

Ready to take your invoicing to the next level? Sign up for actiTIME and start making your billing as effortless as it should be!

How to Create Perfect Professional Invoices

Step 1: Track time

The first step in creating perfect professional invoices is to diligently track your time. Having a precise record of the hours you’ve invested in a project means you get paid the exact amount of money for the work done.

Now, don’t worry – you don’t need to manually write down every single minute spent! There are numerous user-friendly apps and tools out there that can make this task a breeze, and actiTIME is one of the best of them.

actiTIME combines thoughtful design and powerful features to help you track time meticulously and turn precise data into accurate invoices:

- First up, we have manual-entry timesheets and the Calendar View to easily keep track of hours against specific tasks and even the exact time you started and finished working on them.

- actiTIME Mobile lets you use one-click timers, making it super easy to start and stop tracking while on the move. This is perfect for those who are constantly out and about but still need to keep an eye on their working hours.

- Taking convenience to the next level, actiTIME offers a browser extension, aka Time Management Assistant. This nifty tool automatically keeps tabs on your online activities, ensuring that every minute is accounted for without manual intervention.

- When it comes to financials, actiTIME shines by allowing you to set the cost of work and billing rates. This means you can track staff-related expenses and project-based revenues down to the hour, ensuring that your invoices are spot-on and reflective of the actual work done.

Explore actiTIME in action – sign up for a free trial here.

Step 2: Decide on the format

Deciding on the format of your professional invoice isn’t just about aesthetics (though looking sharp definitely scores points). It’s about selecting a format that’s clear, comprehensive, and consistent.

Your client’s eyes should glide through the document, picking up vital details without getting bogged down in clutter. Think about the layout! A clean, minimal design works wonders.

Make sure to include all the relevant details and contents we mentioned above (not more, not less) and organize the body of your invoice in a proper way. For instance, you can use columns to segregate descriptions, quantities, rates, and totals. And don’t get fancy with fonts – stick to something readable and professional.

Not sure which format to stick to yet?

Why not check out our free invoice templates for Excel and Word here?

For an even simpler solution, automate invoicing with actiTIME – it ensures a smooth and efficient invoicing process, saving you both time and hassle.

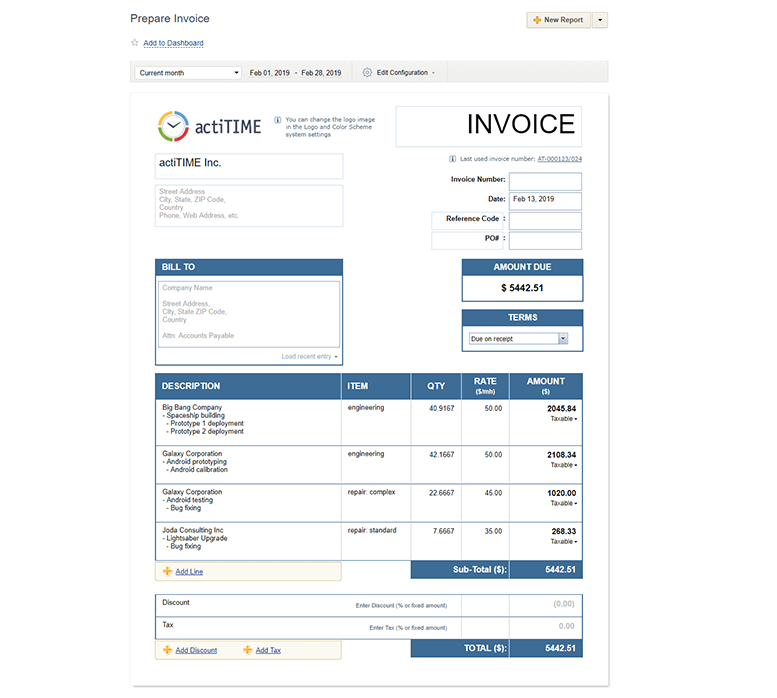

Here’s how it works:

- First off, log the hours you’ve worked on different tasks and projects. actiTIME makes this super simple with its intuitive time tracking interface.

- Once your hours are logged, you can generate detailed invoices with just a few clicks. These invoices can be customized to include all necessary details like completed tasks, hourly rates, and any additional expenses or discounts.

- Lastly, export the invoice in PDF and send it out to clients.

- Besides, you can save the created invoices as shortcuts to avoid configuring them again.

Now, think of all those hours you used to spend manually creating invoices. With actiTIME, they’re yours to reclaim! Plus, actiTIME reduces errors, which means fewer awkward conversations with clients or billing disputes.

Step 3: Personalize your professional invoice

Personalizing doesn’t mean adding neon fonts and unicorn stickers, but rather ensuring your invoice reflects your brand’s personality and professionalism.

Just add a dash of flair to make your invoice stand out:

- Start by including your logo and using your brand’s color scheme. It sets the tone right from the get-go and makes your invoice instantly recognizable.

- Next, address your client by name. “Dear [Client’s Name],” sounds much friendlier than a generic “Dear Customer.”

- Mentioning specific details about the project or service provided can also make the invoice feel more personal and relevant. “It was fantastic collaborating on the [Project Name] with your team” can go a long way in showing you value the relationship, not just the transaction.

Pro tip:

actiTIME offers an intuitive interface to customize every aspect of your invoices.

Want to add your company logo? No problem. Just upload the image, and voila, your brand is front and center.

You can also tailor the invoice details to suit your client’s needs – add personalized messages, adjust service items, and even set payment terms that work best for you and your clients.

Plus, the software remembers these settings for future invoices, saving you time and effort. So, give it a try!

Conclusion

By ensuring your invoices are clear, concise, and aesthetically pleasing, you not only simplify the payment process but also convey professionalism and reliability.

In the end, timely invoicing combined with friendly follow-ups can make all the difference in getting your hard-earned money into your hands faster. So, as you move forward, take the above best practices to heart, and watch your cash flow improve while you focus on growing your business!