With expenses piling up and budgets tightening, keeping track of every dollar spent is imperative for financial health and stability. This is where expense tracker apps come into play, turning the tedious task of managing finances into a seamless, almost effortless process.

From detailed reports to real-time spending alerts, these digital assistants are designed to make your financial life more organized, transparent, and ultimately, more manageable.

Whether you’re a business owner seeking to streamline your company’s spending or an individual trying to keep a tighter leash on personal expenditures, this article unveils the 10 best expense tracking apps that promise to enhance the way you manage your money.

7 Best Expense Trackers for Businesses

1. actiTIME

Key features:

- Staff-related cost tracking

- Invoicing

- Billable vs. non-billable tasks

- Estimates

- Time tracking

- Project reports

- Mobile app

As a multifunctional time tracking solution, actiTIME doesn’t just track hours but gives you insights on where all those precious resources are going. It gives a bird’s-eye view of your projects, helping you spot which tasks are eating up more time and money than they should, and allowing you to adjust performance accordingly.

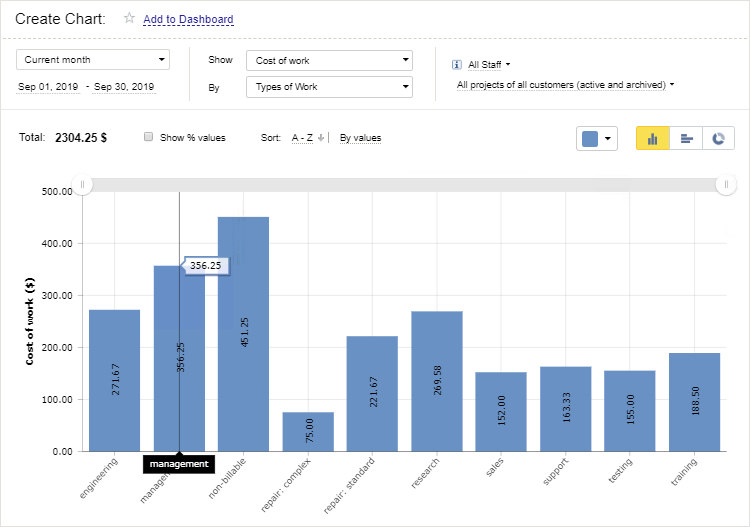

Here’s how actiTIME lets you track your project costs and revenues:

- Cost tracking: You can set hourly pay rates for your team members, and actiTIME will auto-calculate the staff-related costs based on the time they’ve tracked. This feature not only streamlines the payroll process but also helps to collect more accurate data on project costs and profitability, helping you make more informed decisions later on.

- Billing rates: actiTIME cleverly separates billable from non-billable tasks and allows you to gauge project revenues at a glance. Never again will you be left pondering which tasks are bringing in the bacon and which are just sizzling away your resources.

- Streamlined invoicing: With a few clicks, you can generate sleek, professional invoices that make it crystal clear for your clients how the project time was spent and what exactly they’re paying for.

- Automated budget notifications: This feature is like your reliable finance buddy who taps you on the shoulder, reminding you to keep an eye on expenses before they balloon out of control.

- Performance reports: These insightful snapshots of your project’s health clearly show where your team shines, which activities are cost- and time-efficient, or where there’s room for improvement.

Best for:

Project-oriented teams of any size

Capterra rating: 4.6 (91 reviews)

Pricing:

- Free 30-day trial

- Free version for teams with up to 3 members

- Paid plans start at $5 per user/month

2. Digits

Key features:

- Automated bookkeeping

- Chatbot

- Reports

- API integration

Digits is all about making numbers make sense – it’s designed to simplify accounting and financial analysis for businesses. From automatic expense categorization to forecasting future trends, it turns what used to be a cumbersome task into a smooth, engaging experience.

Digits is like a financial guru on steroids:

- Automated bookkeeping: With AI-powered data categorizations, Digits sorts through your financial haystack to find the needles, organizing everything in a way that makes sense. Plus, thanks to API integrations, all your data gets synced perfectly with zero effort on your end. It’s like having a team of accountants living in your computer, tidying up your financial mess while you binge-watch your favorite series.

- AI Advisor: Basically, it’s a chatbot capable of feeding you actionable financial insights, offering tailor-made advice on how to grow your business smarter and faster. Just ask, and it answers.

- Detailed reports: Digits gives you customizable, easy-on-the-eyes reports that actually make you want to dig into your financials. These reports transform what used to be a snoozefest into something you can understand and act on, with beautiful visuals to boot.

Best for:

Small businesses and startups

Capterra rating: 5 (1 review)

Pricing:

Starting from $350 per month

3. Emburse Certify

Key features:

- Expense tracking

- Reports

- Automated mileage tracking

- Accounting integrations

No more crumpled receipts, confusing spreadsheets, or chasing down employees for expense reports. Certify steps in with its sleek, user-friendly platform, automating the entire expense tracking and reporting process.

Here’s how Certify can improve cost management in your business:

- Virtual cards: These nifty cards are like giving your employees a budget on a leash, helping you keep a tight rein on spending without the hassle of paperwork.

- Mileage tracking: Thanks to GPS data, the software tracks every mile with the precision of a hawk, making reimbursements accurate and completely hassle-free.

- Automated reports: Forget about chasing employees for their expense reports – Certify does the nagging for you. It rolls out reports based on a preset schedule so you can have that much-needed visibility into your company’s expenses, all without lifting a finger.

Best for:

From small businesses to large enterprises

Capterra rating: 4.7 (1279 reviews)

Pricing:

No information available

4. Expensify

Key features:

- Invoicing

- Corporate cards

- Receipt scanning

- Automated payments

Whether you’re a freelancer juggling multiple gigs or a business owner with a whole team’s expenses to manage, Expensify swoops in to save the day (and your sanity) by automating the entire process. Just snap a photo of a receipt and boom – it’s logged, categorized, and ready to be reported. What’s easier than that?

Here are just a few benefits you can get with Expensify:

- Invoicing: You can customize invoices to reflect your brand identity and keep communication with clients and partners professional and consistent. Furthermore, you can generate invoices both individually and in bulk, which significantly speeds up the billing process.

- Expensify Card: With its help, you don’t have to worry about keeping receipts or submitting them to the system later. The card does just that while also automatically categorizing each expense.

- Budgeting: Expensify doesn’t just track your expenses – it helps you stay ahead by setting budgets that make sense for you or your business. It’s like having a future-looking crystal ball that warns you before you overspend, ensuring your finances are always on the right track.

Best for:

Freelancers and small businesses

Capterra rating: 4.5 (1077 reviews)

Pricing:

$5-9 per user/month

5. Payhawk

Key features:

- Corporate cards

- International reimbursements

- Mileage tracking

- Payment management

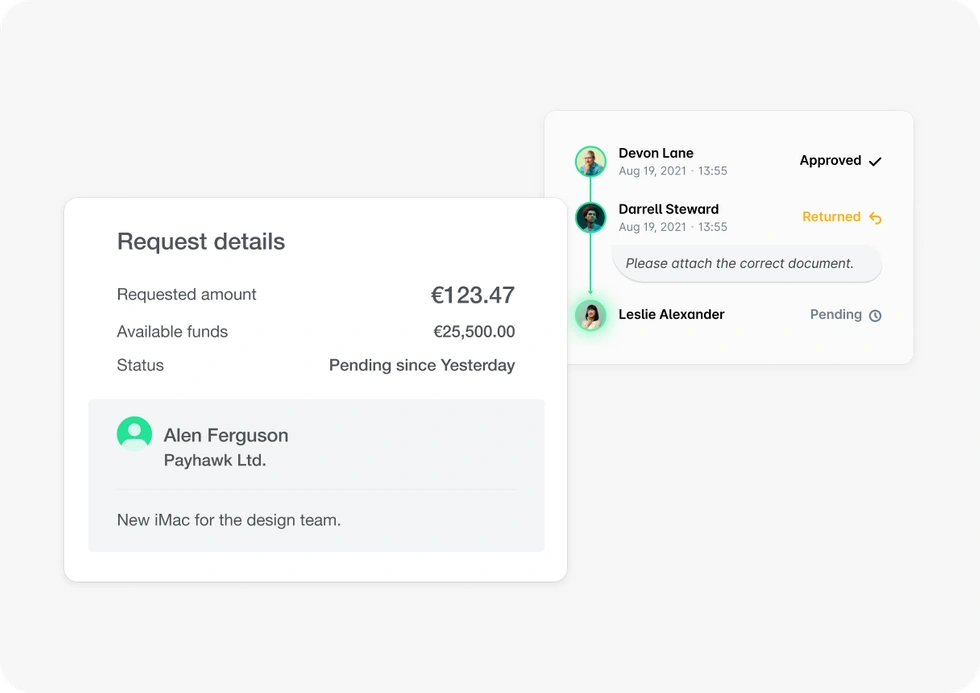

Imagine having one platform that lets you issue cards, manage expenses, invoices, and even budget better – that’s Payhawk. Think less paperwork, more clarity, and a whole lot of time saved for the things that matter.

Here’s what makes Payhawk stand out:

- Global reimbursements: Payhawk supports operations in 7 currencies and in over 32 countries. Thus, it helps international teams get paid quickly, without the headache of currency conversion.

- Payment management: Whether you’re issuing invoices or paying suppliers, every operation is centralized. No more jumping between different platforms or tools – Payhawk keeps everything tidy and in one place.

- ESG reporting: In a world that’s becoming increasingly conscious of environmental impact, having the ability to monitor and report on these factors is priceless. Payhawk makes it a breeze to peer into your supply chain and collect data about your carbon emissions, helping you make greener choices.

Best for:

International teams, both large and small

Capterra rating: 4.6 (115 reviews)

Pricing:

Contact Payhawk for pricing information

6. Rydoo

Key features:

- Automated expense approval

- Corporate cards

- Receipt tracking

- Mobile app

Rydoo swoops in to make the tedious tasks of tracking business expenses, managing receipts, and planning trips as easy as snapping a selfie. Whether you’re jet-setting across time zones for business meetings or grabbing a quick lunch between client calls, Rydoo’s got your back, making sure you can focus on the important stuff.

Here’s what makes Rydoo one of the best expense tracker apps:

- AI-powered receipt tracking: Gone are the days of sifting through piles of paper or scrolling endlessly through your phone’s photo gallery. Snap a picture, and Rydoo will magically extract all the necessary info, categorizing it for you.

- Custom expense control workflows: You can set up your own financial guardrails that gently nudge you with warnings or automatically steer expenses through the approval process based on bespoke policy rules you create. This means you spend less time worrying about policy violations and more time focusing on what matters.

- Cost reports: Rydoo digs into your expense data, uncovering trends and insights that can inform your budgeting decisions and help you streamline operations for better efficiency. It’s like having a financial strategist in your pocket, helping you to optimize spending and boost your business’s financial health.

Best for:

International teams, both large and small

Capterra rating: 4.4 (193 reviews)

Pricing:

Starting from $9 per user/month

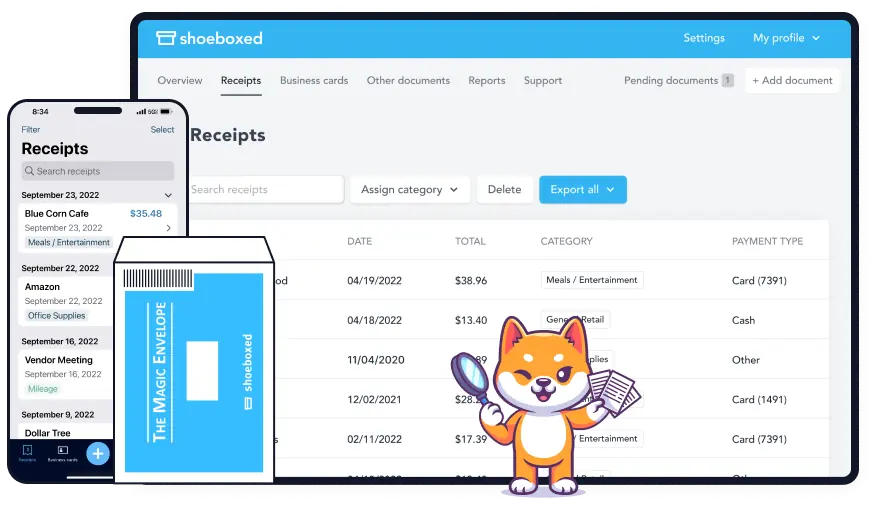

7. Shoeboxed

Key features:

- Receipt scanning

- Human verification

- Reports

- Gmail plugin

Wanna get a digital assistant who’s obsessed with keeping your financial paperwork neat and tidy? Then, Shoeboxed might be the best choice for you. It’s is a game-changer for anyone buried under a mountain of receipts and business cards.

So, what does Shoeboxed do?

- Human verification: When you scan and upload your receipts, real humans (not robots) double-check the data to ensure that extra level of accuracy.

- Magic Envelope: This feature is as cool as it sounds – you stuff an envelope full of receipts, business cards, or other paper clutter and send it off to the Shoeboxed team who then scans, organizes, and categorizes everything for you. It’s like sending your receipts on a spa retreat and getting them back as organized, digitized data. Pretty magical, right?

- Integration with QuickBooks Online: It effortlessly syncs your transactions, making tax time less of a headache and helping you cut down on that mountain of paperwork.

Best for:

Small teams who need an accurate receipt tracking solution

Capterra rating: 4.4 (225 reviews)

Pricing:

Starting from $18 per month

3 Best Expense Tracker Apps for Personal Use

1. 1Money

Key features:

- Visual dashboards

- Financial goal tracking

- Budgeting

- Multiple currencies

1Money is a financial planner, a savvy accountant, and an economist all rolled into one. It helps to track where your cash is going, stick to your budget, and maybe even squirrel away some savings for that dream vacation or a rainy day.

Here’s how 1Money brings the ease and insight into personal finance management:

- Transaction tracking: The process is as effortless as it gets – a simple manual entry with just a single tap. This means whether you’re sipping coffee or waiting in a checkout line, keeping track of your expenses is literally at your fingertips, eliminating the guesswork from where your money goes.

- Visual reports: 1Money takes your financial data and transforms it into colorful, easy-to-understand graphs and charts. This isn’t just about looking pretty – it’s about giving you a clear, immediate understanding of your spending habits over time, helping you spot trends and make smarter decisions with your dough.

- Debts and savings goals: The app helps you keep a close eye on debts to manage and reduce them effectively while simultaneously monitoring your savings, making it easier to hit those financial milestones.

Google Play rating: 4.6 (122K reviews)

Pricing:

Free

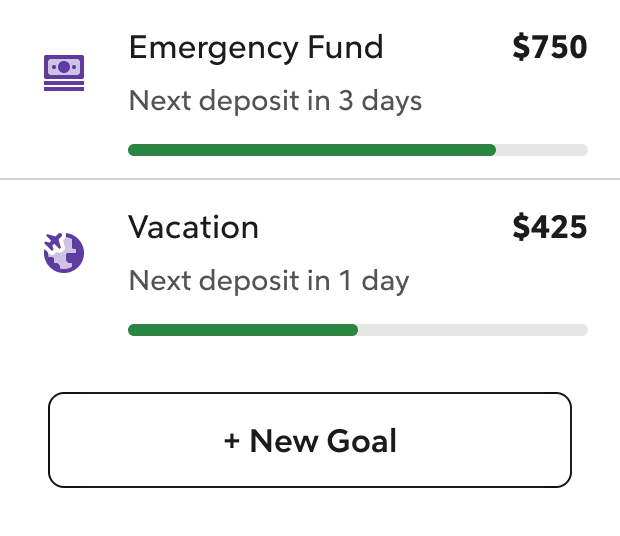

2. Rocket Money

Key features:

- Smart savings

- Net worth tracking

- Budgeting

- Subscription management

Need some assistance tacking those sneaky subscription charges you forgot about, getting out of debt, and saving more money for the future? Welcome Rocket Money – one of the best expense tracking apps that will always have your back when it comes to keeping your hard-earned money where it belongs – with you!

Let’s break down what makes Rocket Money a must-have in your financial toolkit:

- Subscription tracking: Ever found yourself scratching your head, trying to recall when you signed up for that one online service you never use? Rocket Money tracks all your subscriptions in one place, so you can see exactly where your money’s going – and cut off the ones just skimming off your account.

- Smart savings: Want to save for a vacation? Or maybe an emergency fund? Rocket Money lets you set goals and customize saving rules in a way that makes sense to you.

- Financial health monitoring: The app keeps you in the know about your overall financial situation. Seeing your assets and debts laid out, clear as day, helps you get a real grasp of your wealth and dive deep into facts and figures to make better decisions moving forward.

Pricing:

Free and premium version.

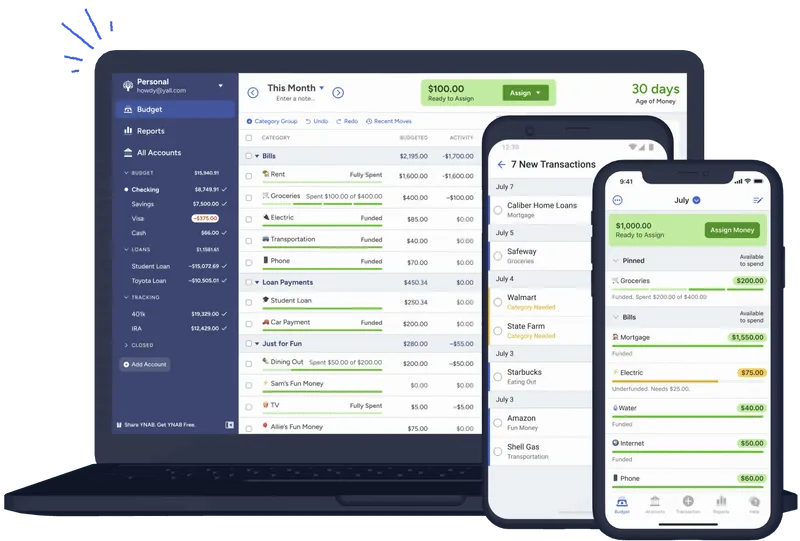

3. YNAB

Key features:

- Saving targets

- Expense reports

- Loan calculator

- Cross-platform support

Unlike traditional budgeting tools that merely track where your money went, YNAB empowers you to plan every dollar before you spend it. This way, YNAB can actually teach you how to manage money more effectively, making you a budgeting ninja in no time.

YNAB comes armed with a suite of features to take the dread out of managing your finances:

- Budgeting: This feature allows you to play the role of a financial strategist. You get to assign available funds to different categories (such as groceries, rent, or weekend getaways). It’s like giving every dollar a job and watching your money work as hard as you do.

- Expense reports: This functionality turns your spending habits into visually appealing, easy-to-understand reports. You get a personalized financial dashboard that not only tracks where every penny goes but also highlights patterns you might’ve missed. This insight is invaluable in adjusting your spending behaviors

- Saving targets: Whether you’re saving up for a new laptop or building an emergency fund, YNAB acts like your personal savings coach, keeping you motivated and on track.

Capterra rating: 4.9 (17 reviews)

Pricing:

Starting from $8.25 per month

Conclusion

Each of the best expense tracking apps we’ve explored in this post brings something unique to the table and caters to diverse needs, from personal budgeting aficionados to business finance maestros. However, for those looking to hone in on tracking staff-related costs and project expenses, actiTIME stands out as a top contender.

It brilliantly balances flexibility with powerful automation to become a go-to for efficient financial oversight.

So, why not give actiTIME a spin for your next project? It might just be that financial guardian angel your business has been waiting for.

Sign up today!