Today’s reviews of bookkeeping solutions tend to revolve around QuickBooks, FreshBooks, and other heavy hitters of this sort. But do you know that the modern market is abundant with a ton of underrated gems in this software category?

Here we are to introduce you to 10 of the best (and slightly less famous) bookkeeping programs for small businesses – some of them are free, while others come at a price, yet all of them are worth your attention.

So, stay tuned!

Bookkeeping Software for Free

1. Manager

Key features:

- Receipt tracking

- Invoicing

- Asset management

- Payroll

With its lavish bouquet of features and free entry point, Manager is a compelling option for startups and small businesses looking to rally their financial management efforts without draining their fledgling coffers.

When unpacking this bookkeeping program for small businesses, you will find a myriad of tools to streamline your daily financial operations.

For instance, you can:

- Snap and save receipts directly onto the platform so your monthly expenditure data is properly organized.

- Create customized invoices that reflect your brand and are free of errors.

- Track fixed assets to ensure smooth operations and keep an eye on depreciating company wealth.

The desktop version of Manager is compatible with Windows, Mac, and Linux. Moreover, it works offline, so you get more data security and don’t have to rely on an internet connection while using the program.

Capterra rating: 4.9 (73 reviews)

Pros:

- Easy to set up and use.

- Simplifies reporting.

Cons:

- Lacks advanced features for financial management.

- User interfaces look a bit dated.

- Limited integrations.

Pricing:

- Free desktop version.

- Cloud version costs $59 per month.

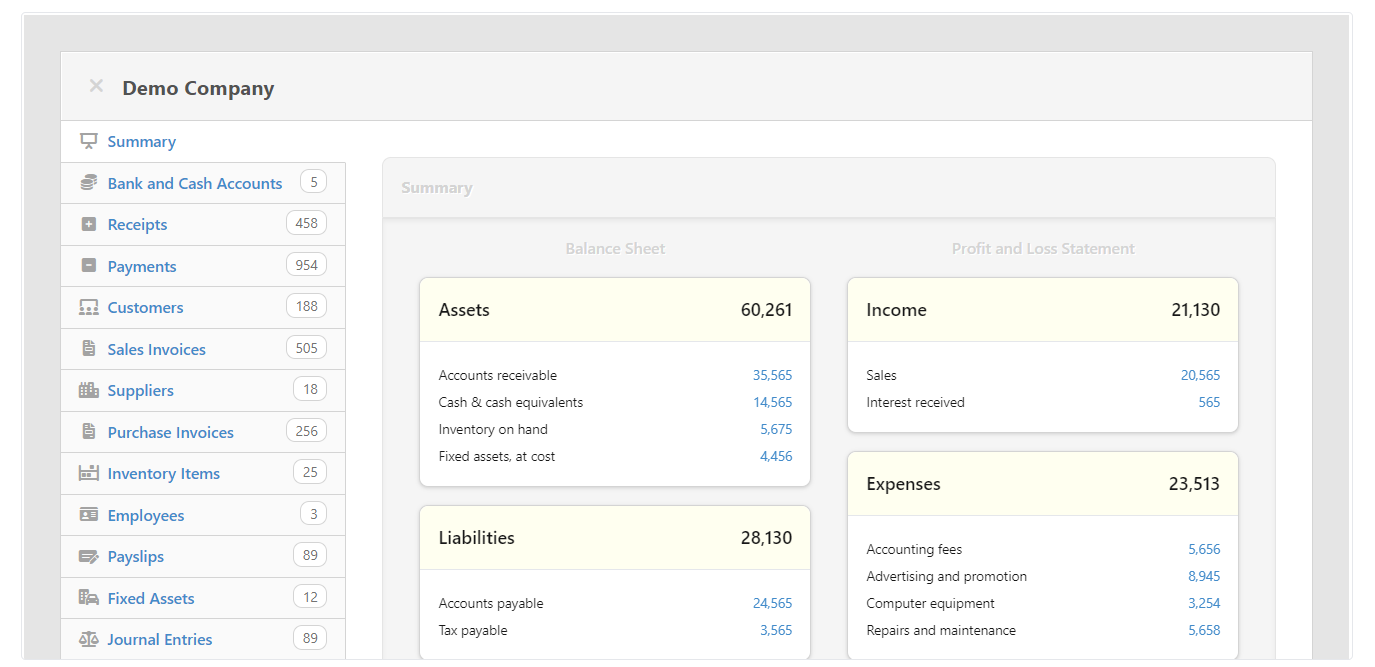

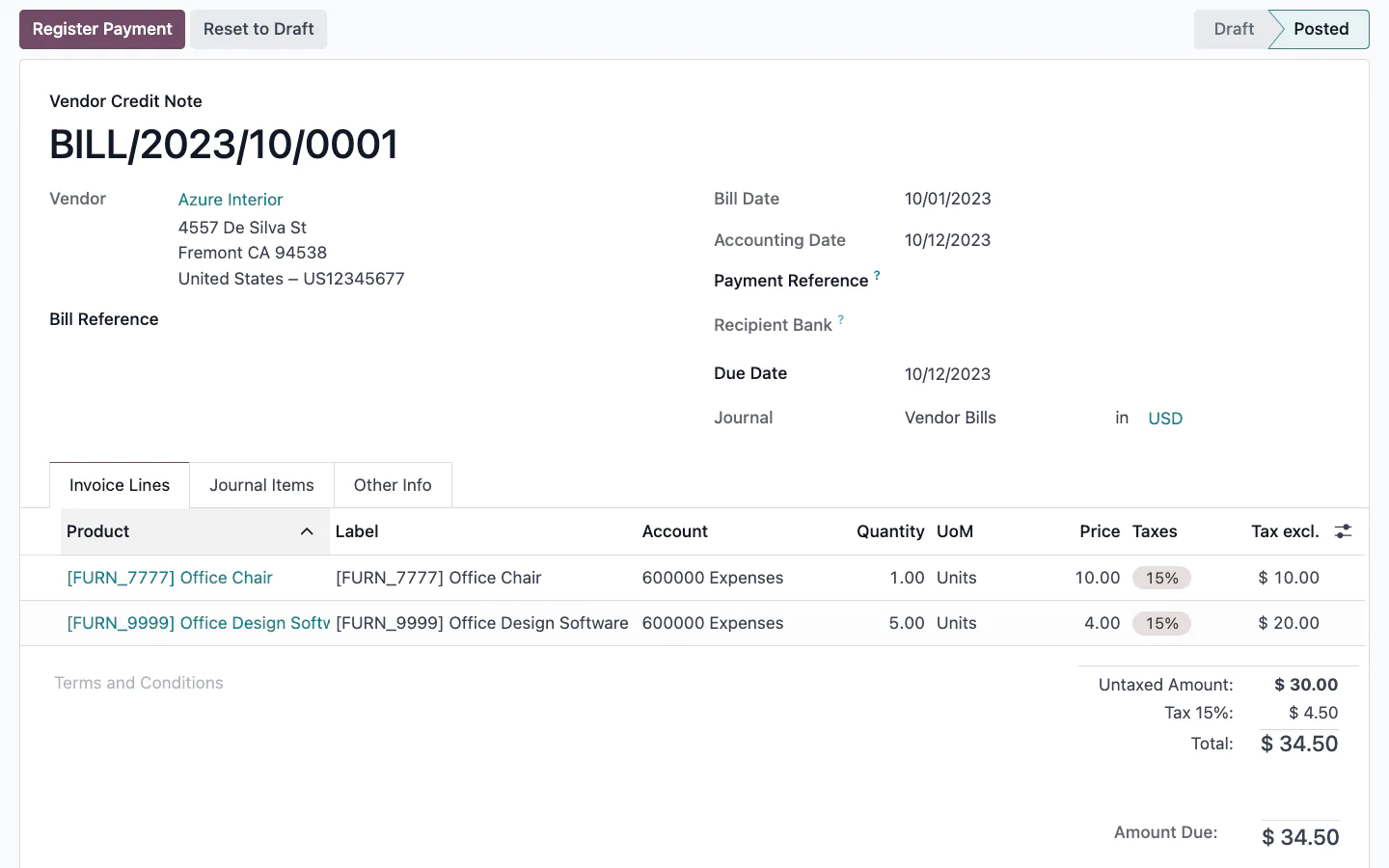

2. Odoo

Key features:

- AI-powered invoicing

- Mobile receipt tracking

- Bank synchronization

- Automated payment follow-ups

Odoo is a comprehensive suite of business applications covering a vast variety of features. As for its accounting module, it simplifies the often-daunting tasks of financial record keeping, payment tracking, and invoicing.

Here are Odoo’s most prominent accounting features:

- Mobile receipt scanning lets you get rid of overflowing receipt folders and manual data entry.

- Built-in AI categorizes your transactions with a high percentage of precision. It generates invoices and reports automatically – all you have to do is look at the data and verify it with a click.

- The bank synchronization feature seamlessly imports transactions from your bank account into the Odoo app, ensuring accuracy and saving you a ton of time.

The Odoo suite offers more than 40 business apps: from CRM to inventory management. It interconnects different software modules to keep your accounting data in harmony with the rest of your business operations and reduce the risk of errors from data silos.

Capterra rating: 4.1 (798 reviews)

Pros:

- Fully customizable open-source version.

- Comprehensive feature set.

Cons:

- Steep learning curve.

- Poor customer support for the cloud version.

- Customization requires technical know-how.

Pricing:

- Free open-source version with community support.

- One app from the cloud suite is always free.

- Paid plans for all Odoo apps start at €11.90.

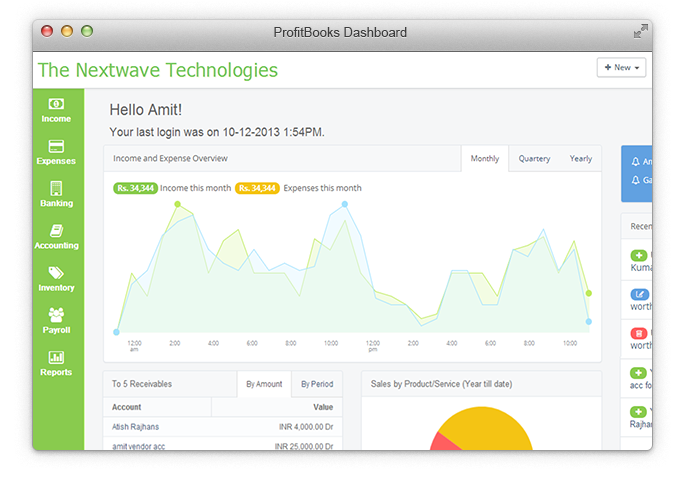

3. ProfitBooks

Key features:

- Expense tracking

- Payment getaways

- Inventory management

- Reports

This bookkeeping program for small businesses stands out for its simplicity. It couples an easy-to-navigate interface with what feels like a fundamental toolkit for small businesses.

ProfitBooks features range from invoicing to inventory tracking:

- Invoices can be created quickly and are fully customizable. You also have the option to integrate payment gateways to simplify transactions and collect revenue from customers promptly.

- ProfitBooks offers more than 45 types of financial reports. While most small businesses wouldn’t have to use all of these reports, the extent of choice does provide comprehensive oversight and fosters informed decision-making about your company’s financial health.

- Inventory tracking functionality allows you to monitor stock levels, identify fast-moving items, and anticipate when to replenish them. It helps to prevent overstock or stockouts, both of which can significantly impact your company’s profit margins.

Capterra rating: 4.5 (74 reviews)

Pros:

- Easy to use.

- Convenient invoicing.

Cons:

- Some features (like the Customers module) seem to be underdeveloped.

- Limited customization options.

Pricing:

- Free version for a single user.

- Free version with limited functionality for startups.

- Paid plan costs $20 per month.

4. Wave

Key features:

- Invoicing

- Payments

- Income and cost tracking

- Payroll

Wave is a top-notch bookkeeping program whose basic tools are entirely free – this makes it an attractive solution for new businesses with limited capital. However, its fundamental features (like cost tracking, invoicing, and online payments) prove that the price point – or lack thereof – isn’t always a sign of poor quality.

The below functionality is at the heart of Wave:

- Your income and expenses are conveniently categorized, visualized, and easily accessible via insightful charts and reports.

- The payroll module lets you handle everything from pay stubs to direct deposits and comply with all applicable tax regulations without much confusion.

- The built-in payment processing functionality standardizes and speeds up billing by providing your clients and customers with the option to settle accounts online with just a click of a button.

Capterra rating: 4.4 (1579 reviews)

Pros:

- Excellent feature set for a free bookkeeping program.

- Intuitive interface.

Cons:

- Customer service may not be great.

- The mobile app is underdeveloped.

- Bank synchronization issues.

Pricing:

- Free Starter Plan.

- Pro Plan costs $16 a month.

Bonus Tool: actiTIME

Key features:

- Manual and automatic time tracking

- Billing rates

- Branded invoices

- Profit/loss reports

- Project estimates

- Automated notifications

- Integrations

- Mobile app

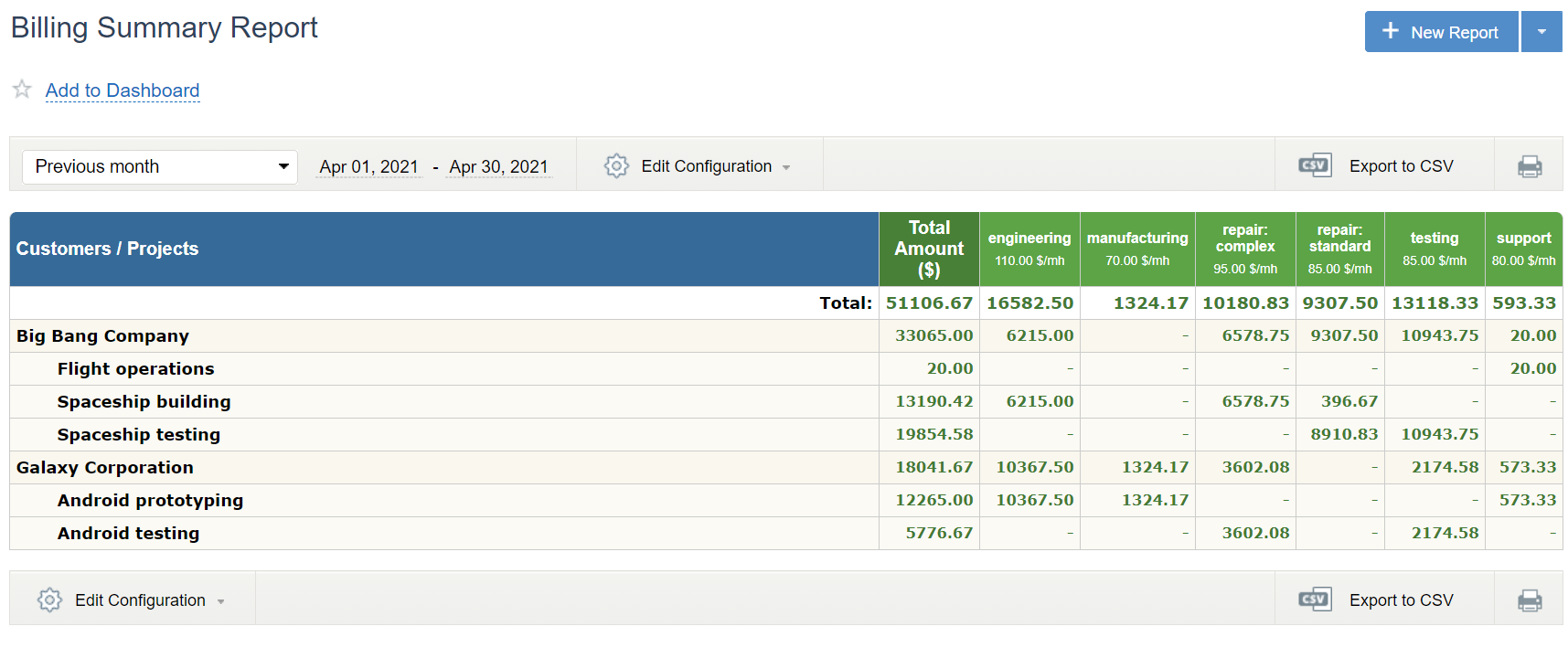

At its core, actiTIME isn’t a bookkeeping program per se – it’s a robust time tracking solution with reliable features for client billing and invoicing. Unlike traditional accounting software, where time tracking often feels like an afterthought or a mere add-on, actiTIME uses it to promote operational efficiency and provide valuable insight into your projects’ financial performance.

Here’s how it works:

- Organize your projects, set deadlines and priorities for tasks, and assign them to employees.

- Establish billing rates for each task so actiTIME can calculate your billable amounts per hour tracked.

- Assign hourly pay rates to your team members to automatically track staff-related expenses.

- Track time using a variety of methods: manual-entry timesheets, one-click timers in the mobile app, or the fully automated browser extension.

- Review and approve timesheets to hold back inaccuracies and make sure that only validated entries flow into your financial streams.

- Generate profit-loss reports based on accurate time tracking data to get insights into the trajectory of your projects and uncover potential blind spots.

- Create invoices that are branded, accurate, and itemized and export them to PDF in just a few clicks.

- Fine-tune automated notifications so actiTIME can warn you of impending budget overruns.

- Integrate actiTIME with your favorite accounting tools through Zapier, API, or built-in synchronization options to streamline accounting more.

Capterra rating: 4.6 (91 reviews)

Pros:

- Makes project management a breeze.

- Allows for accurate billable time tracking.

- Lets you create professional-looking invoices in a snap.

- Offers a diversity of integrations to streamline accounting.

- Boosts efficiency thanks to automation.

- Easy data export.

- Flexible settings

Cons:

- Lacks advanced bookkeeping functionality.

Pricing:

- Free 30-day trial.

- Free version with basic features for 1-3 users.

- Paid plans start at $5 per user/month.

Paid Bookkeeping Programs for Small Businesses

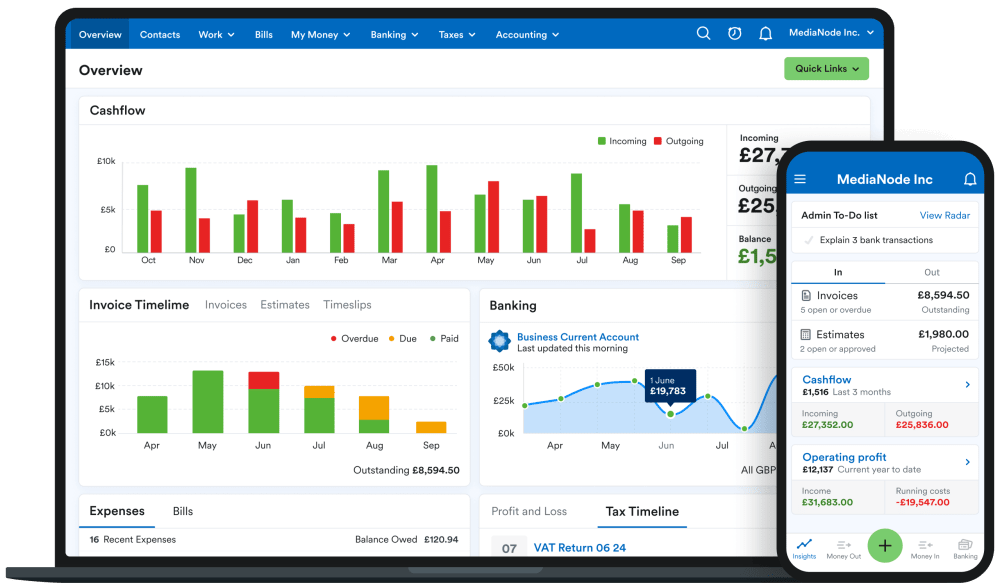

1. FreeAgent

Key features:

- Expense tracking

- Cost estimates

- Bank synchronization

- Invoicing

Designed to streamline everything from invoicing to hour tracking, FreeAgent pledges to liberate small businesses and freelancers from the tedium of manual number crunching.

FreeAgent includes all the basic features that a decent bookkeeping program for small businesses offers, but the below features make it stand out:

- Cost estimate templates and automated reports simplify the quoting process. They also help to maintain profitability by accurately forecasting your project expenses and potential income.

- The time tracking module offers a straightforward way to capture the exact number of hours spent on client projects. It promotes accurate invoicing and ensures that employees are paid fairly.

- A handy mobile app puts financial management right in your pocket. It features receipt scanning that cuts down on manual data entry and helps to keep expense records up to date with minimal effort. Additionally, the app’s one-click timers let you track work hours on the go, making it simpler to bill clients accurately even when you’re constantly moving around and can’t fill out your timesheets manually.

Capterra rating: 4.5 (162 reviews)

Pros:

- Provides good insight into the overall financial situation.

- Fairly easy to use.

Cons:

- Feels clunky.

- Reconciling bank transactions is time-consuming.

Pricing:

- Free 30-day trial.

- $13.50 per month for the first six months. Then, $27 per month.

2. Holded

Key features:

- Automated ledger entries

- Asset tracking

- Profit and loss reports

- Bank synchronization

Holded integrates accounting, invoicing, inventory management, and project management into one sleek, user-friendly dashboard. With its assistance, you can streamline operations, automate tedious tasks, and get real-time insights into your financial performance.

Holded strives to reduce manual input and increase accuracy:

- It simplifies ledger management a great deal. You can set up custom bookkeeping rules just once and every new invoice will automatically result in a corresponding ledger entry – this automation not only saves precious time but also minimizes human error.

- The automatic asset counting feature keeps a real-time tally of your assets, ensuring that your financial reports are always up-to-date (while you don’t even have to lift a finger).

- Comprehensive balance sheets, profit and loss statements, and other essential financial reports give a clear picture of your company’s financial health, enable informed decision-making, and facilitate strategic planning.

Capterra rating: 4.5 (119 reviews)

Pros:

- Boosts efficiency.

- Helpful and responsive customer support.

Cons:

- The mobile app could be improved.

- Available integration options are not enough for some users.

Pricing:

- Free 14-day trial.

- Free invoicing functionality for freelancers.

- Plans for businesses start at €14.5 per month (for the first 3 months).

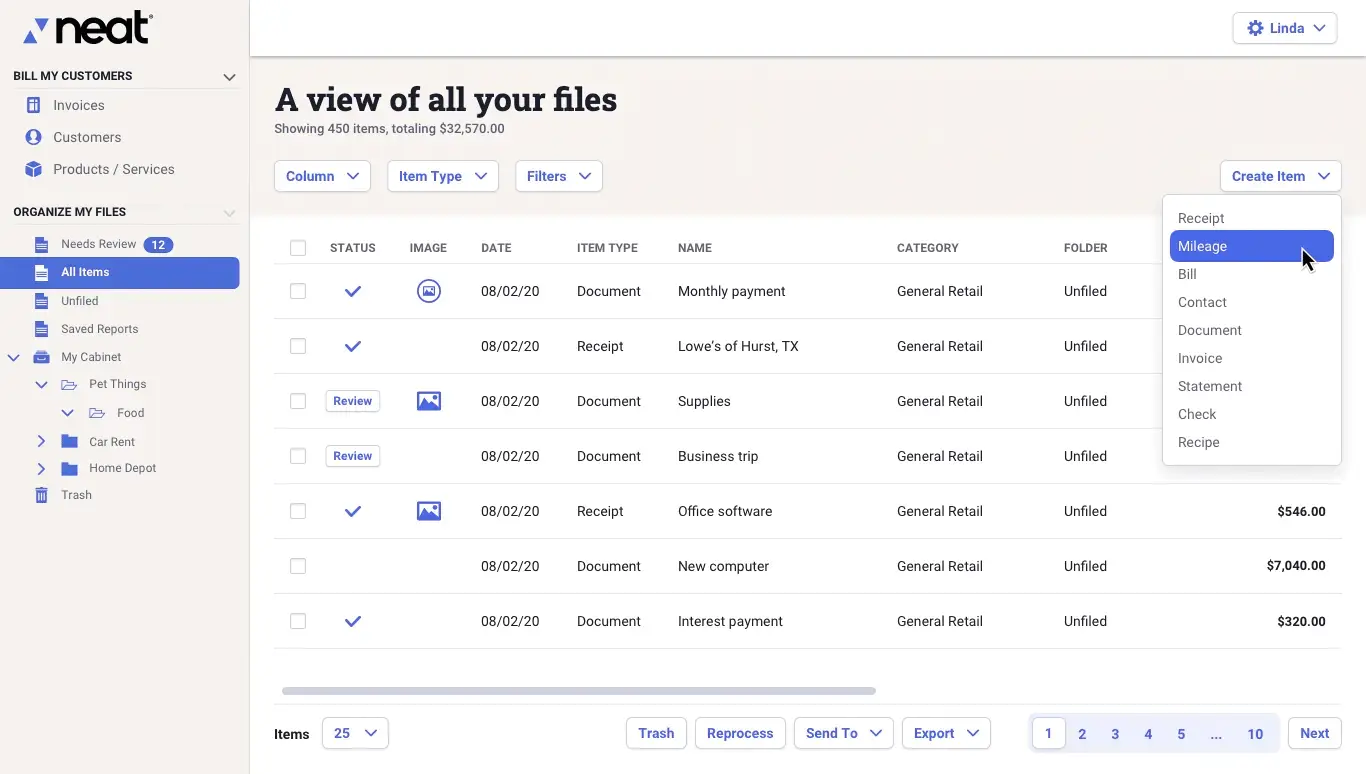

3. Neat

Key features:

- Receipt tracking

- Reconciliation

- QuickBooks integration

- Document management

This intuitive bookkeeping program for small businesses turns piles of receipts and invoices into digital data you can easily manipulate and use. You can scan, upload, or even email your financial documents to the platform, and it will categorize and store them securely in the cloud.

Here’s how Neat helps you stay organized and efficient:

- The receipt scanning feature allows you to digitally capture and store receipts with just a click. It eliminates piles of paperwork and allows you to track expenditures and prepare for the tax season without a hitch.

- You can categorize expenses and documents with custom tags that make sense for you or your business. They simplify bookkeeping a great deal and speed up the process of finding the right documents when you need them.

- QuickBooks integration seamlessly syncs your financial data between the platforms, ensuring that your accounts are always up to date. It’s perfect for streamlined accounting as it helps to report and analyze your data at a more professional level that Neat alone cannot support.

Capterra rating: 4 (100 reviews)

Pros:

- Simplifies document management.

- Easy to use.

Con:

- Lacks advanced accounting features.

Pricing:

- $200 per year (+ $50 per year for premium customer support).

4. OneUp

Key features:

- Bank synchronization

- Daily financial reports

- Invoicing

- Inventory tracking

OneUp is a dynamic bookkeeping program for small businesses. It automates everything from expense reporting to bank reconciliation, thus simplifying the backend work that often eats into valuable time.

Unlike many other bookkeeping programs, OneUp marries your business finances and customer relationship management:

- Customizable invoice templates allow you to whip up professional-looking invoices that you can tailor to match your brand’s vibe and rest assured you always make a great impression on your clients.

- The bank synchronization feature links OneUp directly with your bank account, automatically updating your financial transactions in real time. With its help, you can wave goodbye to the headache of manual data entry and get a complete and crystal-clear picture of your ongoing cash flows.

- The CRM module lets you track leads, pinpoint new sale opportunities, and manage quotes with such ease that it feels like the system is doing half the work for you.

So, whether you’re just nurturing potential clients or locking down sales, OneUp has your back every step of the way.

Capterra rating: 3.7 (6 reviews)

Pros:

- Good value for the price paid.

- Easy to use.

Cons:

- Lacks many essential features (like payroll and time tracking).

- Customization could be improved.

Pricing:

- Free 30-day trial.

- The plan for a single user costs $9 per month (no customer support).

- Plans for teams start at $19 per month.

5. TrulySmall

Key features:

- Invoicing

- Accounting reports

- Cost estimates

- Expense management

True to its name, this bookkeeping program is perfectly tailored for the little guys of the business world. It takes the stress out of accounting tasks, allowing you to focus more on growing your business and less on the nitty-gritty of number crunching.

Here’s how TrulySmall can improve the way you manage your cash flows and budgets:

- Automatic reminders gently nudge your clients, helping you get paid faster. They rid you of those awkward conversations while making it easy to stay on top of invoices.

- Visual spending reports provide an in-depth picture of where your money’s going each month. No more spreadsheets or guesswork – just strategic, informed decisions about your finances.

- Thanks to built-in automation, your transactions are neatly sorted and filed away so that bookkeeping becomes a breeze. It makes you better organized and prepared for the hectic tax season without the troubles of manual data entry or messy human errors.

Capterra rating: 3.6 (5 reviews)

Pros:

- Simple interface.

- Good customer support.

- Easy mobile access.

Cons:

- May not be suitable for businesses with many daily transactions.

- Sometimes transactions get mislabeled.

Pricing:

- Free 14-day trial.

- The invoicing app costs $8.99 per month.

- The expense tracking app costs $8.99 per month.

- The accounting app costs $20 per month.

6. ZarMoney

Key features:

- Invoicing

- Payables calendar

- Quotes and estimates

- Bank reconciliation

ZarMoney knows the intricate dance of dollar and data better than most. Its interface is a canvas of financial hues – contact management, inventory, sales, purchasing, and accounting, all under a single roof.

Like any comprehensive solution, ZarMoney requires quite some time to master. And while this might deter those looking for quick accounting fixes, the software can really impress you with its versatility and depth.

For instance:

- Its customized quotes and estimates allow you to improve initial interactions with clients by injecting professionalism in the early innings of the business courtship. It offers attention to detail that can set you apart in a crowded market and win a deal.

- ZarMoney lays out your payment commitments in an intuitive calendar view. It provides a visual aid that helps you stay current on your payments and helps to prevent any late fees or lost opportunities.

- The purchase orders feature ensures you always have stock on hand without overloading your shelves. By streamlining the purchase cycle, it bridges the gap between anticipation and execution, securing the correct materials at the right time and, ultimately, honoring client commitments on delivery.

Capterra rating: 4.7 (83 reviews)

Pros:

- Comprehensive feature set.

- Great customer service.

Cons:

- Steep learning curve.

- Inventory management with many items can be complicated.

Pricing:

- Free 15-day trial.

- Starting from $20 per 2 users/month (+ $10 per each extra user).

Conclusion

Beyond the well-trodden paths of QuickBooks and FreshBooks, we’ve explored a variety of bookkeeping programs for small businesses, each catering to different preferences and needs.

Whether you prioritize affordability, user-friendliness, or comprehensive features, there is a solution to make your accounting life easier. And in case you want to combine accurate client billing with easy time tracking, actiTIME is surely your best choice.

Use it to set billing rates for tasks, track profits and costs in projects, streamline invoicing, and run detailed performance reports.

Explore these and other actiTIME features during a free 30-day trial to get a taste of how it can streamline your bookkeeping tasks.